Our Mythos Thesis

Publish Date: Apr 29, 2024

Author: Vincent Jow

Executive Summary

Mythical (MYTH) is a leading Web3 gaming company founded in 2018 by gaming veteran John Liden and Jamie Jackson. MYTH is transforming itself from a 1st party game studio to a leading web3 gaming platform, which can drive a significant re-rate in the valuation (from $300M to a multi-billion outcome). Immutable (IMX) also started with a 1st party (1P) game Gods Unchained and Ronin (RON) started with 1P game Axie Infinity. They then expanded to allow 3rd party (3P) games to build on their platform, which has led to a re-rate in the valuation. Similarly, MTYH is expanding from 1P games to allowing other 3P games to build on its platform. With IMX at $5B fully diluted valuation (FDV), RON at $4B and BEAM at $2B, MYTH is undervalued at $400M as it makes this transition, with a renewed focus on the token.

Mythical has one of the most experienced teams in the space. CEO John Linden was Studio Head at Activision overseeing Call of Duty franchises before founding his own game studio, which sold to Niantic. CCO Jamie Jackson also founded a gaming studio that was acquired by Activision, where he became Studio Head.

Mythical has a truly differentiated technology that fulfills the web3 promise of giving gamers ownership of their assets. As we have seen repeatedly in web3 gaming, games are tempted to issue tokens as a substitute for true organic demand and engagement. The result of this is the token, not the game, is the product. This often leads to tokens running up as people point to the non-organic fundamental traction, before crashing spectacularly. Mythos has a truly differentiated Apple & Google approved tech stack that shows sustainable, non-inflationary uplift for mobile game studios by creating an in-app secondary marketplace. Any game studio can build on MYTH infrastructure to get a sustainable 20% uplift on its revenue, no token or web3 experience necessary.

Market Overview

Gaming is a $180B market with 3B users worldwide, growing at low to mid-single digits annually. Mobile gaming is the largest part of that market, accounting for 50% share. Mobile has historically been the highest growth driver of the industry but has faced challenges regarding monetization and user acquisition in recent years.

Source: Newzoo

The gaming industry has undergone several major shifts both from form factor (arcade to mobile) as well as monetization (discs to live services & free-to-play). We believe that web3 gaming is just another evolution in the gaming market, which unlocks higher monetization, engagement and retention versus traditional gaming.

Source: Visual Capitalist

The half-life of games has been a persistent problem in video games. Within mobile, ~80% of mobile games have a 3 year mortality rate and ~75% of games hit peak revenue within a year. Mobile games resort to updating their titles weekly and monthly. Within console gaming, Activision (ATVI) has three separate studios working on a different Call of Duty to ensure a new Call of Duty is released every year, which consistently sells ~20M units a year and comprises of ~30% of ATVI revenue. All of the sports titles (FIFA, Madden, etc.) publish a new title every year as well. The large public scaled publishers have studios all over the world constantly working on new games to build a portfolio of titles that dampen the revenue volatility, stacking revenues from multiple titles to drive growth. It is extremely difficult for a single game studio to survive this competitive landscape.

Furthermore, it is extremely difficult to ship an AAA game. Studios spend $50-250M and 3-5 years to ship a game. While anyone can spend $5-10K to create a high quality video game trailer, it takes significant industry expertise and resources to deliver an AAA title. For example, CDK Projekt Red was an extremely high profile gaming studio, with the extremely successful Witcher franchise. They spent $300M+ and 5+ years to develop Cyberpunk 2077 (announced May 2012 and released September 2020) which was a massive flop and lead to a stock price decline of 80%+ and class-action lawsuits.

Source: Public filings

Web3 Gaming

Web3’s original gaming vision is that by giving gamers ownership of their assets within games, games can create a robust secondary market that leads to higher monetization, engagement and retention. This benefits both gamers and game studios. Players can also use their assets in the broader web3 ecosystem (loan and rent) and, over time, potentially be compatible or at least recognized by other games (e.g. status matching). Today, gamers spend on cosmetics and skins but do not actually own their items.

To give perspective on the size of secondary markets,

eBay unlocked $75B of used goods with the creation of a trusted digital secondary marketplace

US home resales are 4M vs. new home sales are 662K (6x larger)

US used car sales are 40M vs. new car sales are 15M annually (2.5x larger)

Used luxury goods have grown rapidly over recent years to $50B (or 14% of new luxury goods)

If there was any question on whether gamers care about monetizing unused assets, Gamestop generated 25% of total revenue and 50% of total gross profit from used video game sales in the 2000’s. Gamers have specifically asked for and have said they are more likely to purchase digital content if they knew they are able to resell it. Today, only a few games allow sellable in-game items (e.g. CSGO, Dota, etc.) Given this is purely digital items with tech-savvy users, we expect the penetration of the secondary marketplace for in-game assets to grow quickly to match primary volumes (as MYTH’s NFL Rivals has shown).

Much like in the rest of crypto, we have seen the use of token incentivizes to try to bootstrap demand, even when product market fit has not been achieved organically. At one point, Axie Infinity became a major employer of the Philippines and engagement levels reached 12+ hours a day vs. 1-2 hours for traditional games, before both users and token price went down 95%. Although these models have been unsustainable, replacing cost of customer acquisition with equity ownership in games in a thoughtful way would lead to higher sustainable engagement and retention of users, much like we have seen in other crypto categories including DePin (decentralized physical infrastructure networks)

Source: ActivePlayer.io

Monetization has always been a contentious issue in traditional gaming. Gamers are notoriously very cost conscious and have historically been very resistant to changes into monetization. DLC, microtransactions and season passes have all been met with gamer resistance. For example, EA’s decision to paywall famous Star Wars characters in Battlefront II led to the most hated comment in Reddit history (680K downvotes) and $3B of market cap wiped from their stock.

That being said, it is clear that gaming has a lot of monetization potential when compared to other forms of entertainment. For example, if the average AAA game costs $60 and gamers play 60 hours, that is $1 per hour. For comparison, seeing a 2-hour movie for $10 is $5 per hour. We believe web3 can help structurally close the monetization gap in a way that benefits both players and game studios by creating a new secondary marketplace that didn’t exist before. Players like it because they get resale value on their items (much like they enjoyed with physical games) and developers like it because they get a new revenue opportunity that is not cannibalistic to their primary sales.

Source: Internal estimates

During the last bull market, we saw teams without any credible gaming expertise get funding to build games. However, web3 gaming investors now have focused on funding teams who have the expertise to build a good standalone game, while being patient enough for them to build and ship. That being said, there are still a lot of pre-launch games with tokens trading at extremely high valuations considering how much execution risk goes into producing a game.

Because of this dynamic, gaming infrastructure has commanded massive valuation premiums over individual games (e.g. IMX $4B FDV, RON $3B, GALA $2B, BEAM $2B, XAI $1B, etc.) Given gaming is such a hit driven business, investors typically do not want to go select which games they think will be successful. Furthermore, we have often found that the price of a game token typically peaks well before its fundamental traction, making it even harder to invest. With gaming platforms, they receive enough shots on goal and there is a perceived network effect of having a portfolio of games within one ecosystem.

Source: Artemis Analytics (as of Apr 24, 2024)

Mythos Overview & Transition

Mythical Games is a leading Web3 gaming company founded in 2018 by gaming veteran John Liden and Jamie Jackson.

Mythical has launched some of the industry’s most successful games:

Blankos Block Party (late 2022). First NFT game to launch on Epic Games. Had 8/10 on GAMS3S and 79% on Google Reviews. Reached 1M users on PC, relaunching on mobile to expand to more users.

NFL Rivals (early 2023). Reached 4M+ users (20% with wallet). Has a license with the NFL. Has 4.8 star review on Apple store.

Nitro Nation World Tour (late 2023). First 3rd party game in soft launch. Has 4.7 star review on Apple Store. Previous title (Nitro Nation) had 80M installs.

Mythical is focused on mobile gaming (50% of the gaming market), highly curated AAA games with strong proven studios and / or strong licenses & IP, which tend to perform strongly. As an example, EA’s FIFA had been one of the highest grossing games of all time, accounting for ~40% of EA’s revenue over multiple decades. Mythical’s ability to win a license from the NFL, which is a multi-year agreement, bodes well for the ability to continue to secure high profile IP.

Mythical has a strong roster of investors across both traditional finance and web3 venture. They also have investors from entertainment & sports, which will be helpful in securing IP and licenses for their games and ecosystem.

Source: Mythos

Mythos also has strong subcommittee members from gaming, including [to update]

Web3 Gaming: Animoca Brands, Klatyn, Sandbox

Web2 Gaming: Ubisoft ($3B European publisher), Square Enix ($4B Japanese publisher), Krafton (PUBG), Com2Us ($160M Korean publisher), Sega,

Source: Mythical Games

Technology Stack

We believe MYTH has one of the most differentiated technology stacks within web3 gaming. They have the first and only in-app Google & Apple approved NFT marketplace. NFL Rivals proved that by giving gamers ownership of assets, one could continue to generate $30M primary sales (as they always had) but also unlock $30M of secondary sales. Importantly, this is done without a token, indicating both primary and secondary demand are completely organic.

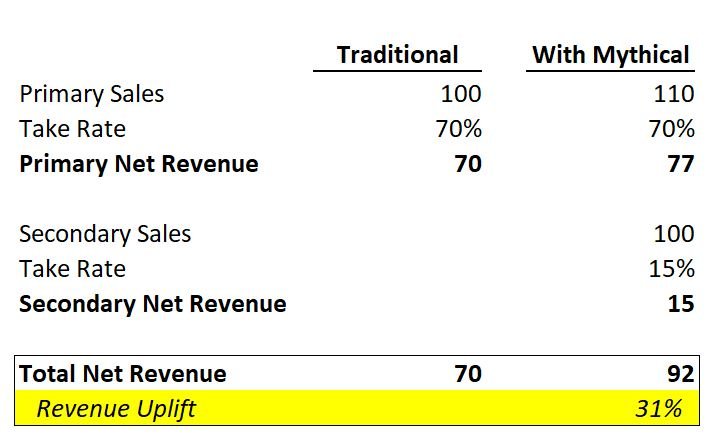

Traditionally, mobile game developers made $100 (illustratively) on primary sales with a 70% take rate (after the 30% cut to Google & Apple), leaving mobile game developers with $70 of net revenue. With Mythical, mobile game developers would make another $100 in secondary sales with a 15% take rate, increasing revenues sustainably by 20%. Additionally, by opening a secondary marketplace, game developers actually also saw a 10% increase in primary sales as new customers are now willing to buy, knowing their assets will have resale value, bringing the total uplift to 30%. We believe that, over time, this can continue trend higher. As a reminder, all the volumes are organic and there are no token emissions or inflationary rewards driving this.

Source: Modular estimates

Mythical has already launched several unique features on top of this. For example, Quicktrades allows players to swap any set of NFTs for any other set of NFTs. This has already resulted in 25%+ lift of secondary revenue. As more and more games build within this ecosystem, it will allow players to easily unlock and trade their NFT assets for other NFT assets on other games on the MYTH platform.

The success of NFL Rivals showcases the potential of the Web3 gaming vision. Giving players ownership of their assets can drive higher engagement, retention and monetization. NFL Rivals could eventually have a token be used to reduce cost of customer acquisition and give gamers equity in the game, but importantly the game has already proven completely organic product market fit.

MYTH Token

For a large part of Mythical existence, the team’s focus has been building high quality technology and 1st party games. Mythical wanted to show how a fun game could incorporate web3 elements to tremendous success. Having done that with NFL Rivals and after building out a robust 1st party pipeline, the focus has shifted to powering other 3rd party games on its ecosystem with the same tech stack.

Along with this transition, MYTH token is undergoing a transformation with Myth 2.0. This includes the following changes:

Migration from permissioned side chain to standalone L1 built on Polkadot

Protocol fee switch and staking

On-chain governance

Self custody to allow gamers to port their wallets

Source: Mythos Foundation Proposal

Fundamentals & Traction

Mythical currently has one of the best fundamentals in web3 gaming, across NFT volume, unique buyers and transactions.

Mythical’s entire ecosystem totals $330M of annualized NFT sales, compared to $270M in annual NFT sales for IMX (Immutable) and $35M for RON (Ronin). (as of Q1 2024)

Source: CryptoSlam

MYTH’s NFT sales also compare favorably to entire blockchains, ranking similarly to Polygon Chain and ahead of Avalanche and Arbitrum.

Source: CryptoSlam

Over time, we believe MYTH can get to a cadence of launching 5+ 1P games and 10+ 3P games. Assuming $50M secondary volumes on each game, we believe there is a path for Mythical to generate $1B of annualized NFT volumes per year. For context, OpenSea currently run-rates at $1.8B annualized NFT volumes. Assuming a 2% take rate on volumes in-line with IMX over time, we believe MYTH can generate $20M off that portfolio.

Within traditional equity markets, AppLovin (APP) is a $26B market cap company that has shown a successful playbook on how this could evolve over time. APP has successfully built a portfolio of 1P mobile games. With this business, they were able to build, partner and acquire enough studios that there would be a constant stream of new game launches. They also had an ad network, which served 3P mobile games as well as 1P games. At time of IPO in 2021, the ad network was only 20% of the overall business. Since then, the ad network has 4x’d and has become the fastest growing mobile ad-network and represents 65% of the business. They use the data on their 1P games to make their ad network the best in the industry, thereby attracting more 3P games to use their software stack. As a result, they have become a truly vertically integrated mobile gaming powerhouse.

Mythical is employing the same strategy by bringing in new web3 tech to mobile game studios, iterating on that tech with its own games and creating a fully vertically integrated stack. Importantly, whereas APP targets in-game mobile advertising, in-app purchases is a much bigger share of mobile gaming revenue at ~65% of the mobile gaming market.

Furthermore, we think there is very interesting call options around:

Polystream (first Poof of Stream decentralized cloud offering). Cloud streaming will massively expand the TAM for gaming, allowing gamers to play high-fidelity games on any screen or connected device. With unlimited processing power, games will be more realistic, persistent and personalized, driving higher engagement and monetization.

AR/VR/Metaverse and Social Gaming. The team has experience at Niantic, Oculus VR and Meta Reality Labs. Blankos Block Party was a massive multiplier online world with user generated content, with similarities to Roblox.

Team

Mythical has one of the strongest teams in Web3 gaming:

John Linden (CEO) was Studio Head at Activision, where he oversaw Call of Duty, the largest revenue contributor to ATVI. After Activision, he founded his own game studio which got acquired by Niantic Labs (creator of Pokemon Go)

Jamie Jackson (Chief Creative Officer) founded his own game studio which was acquired by Activision, where he joined as Studio Head and oversaw the Guitar & DJ Hero franchises

Aaron Goolsbey (COO) was Global Head of Developer Partnerships & Operations for Meta (Reality Labs) and Head of Platform For Battle.net at Activision

Jeff Poffenbarger (Studio Head) was Studio Head at Oculus VR, responsible for directing and guiding the real-time experiences studio. Prior to Oculus, he was a Senior Executive Producer at Activision.

Source: Mythical Games

Valuation & Scenario Analysis

Below, we present a few scenarios and illustrative assumptions for MYTH’s key drivers:

Base Case: We believe if MYTH successfully makes the platform transition (e.g. focus on the token and getting a strong pipeline of 3P games to build on MYTH), MYTH should be valued at least similar to RON or IMX (e.g. $4-7B), given MYTH is already fundamentally similar today. For numbers, we model path to $1B of GMV with 2% take rate at a 200x multiple.

Upside Case: If MYTH can penetrate 10% of mobile gaming in-app purchases, this would be $6.5B of GMV. For numbers, we model at a 100x multiple, resulting in $10-20B of market cap (which is similar to APP).

Downside Case. We think there is quite a lot of downside protection given MYTH is trading where pre-launch games are trading and is the cheapest gaming platform in Web3 with similar fundamental metrics as the leading platforms.

For public market context, AppLovin is $26B and Unity is $10B in market cap. For US major game publishers, Electronic Arts is $34B, Take Two $25B and Roblox $24B. Activision was acquired by Microsoft for $69B.

Dislcaimer: all forecasts and assumptions are hypothetical

Risks & Mitigants

Competition. There are a few web3 gaming platforms, but all can be big outcomes and successful. IMX has hundreds of game launches from studios that span from indie to AAA. RON is targeting more web3 crypto native gaming studios with a large on-chain presence in Asia. MYTH is targeting highly-curated, extremely AAA mobile gaming studios

Polkadot Chain. There have been a lot of questions regarding the Polkadot chain choice. Although a lot of builders have spoken highly of Polkadot tech stack (EWT, PEAQ, etc.), there have been concerns around the business development & marketing. We believe the Web3 Foundation is focused on attracting developers to build on their platform by reducing the barriers to entry and increased go-to-market focus. However, given the existing Polkadot sentiment, we believe any improvement to Polkadot is a call option & tailwind to MYTH but not necessary for MYTH to be successful. Said another way, we believe MYTH can be bigger than the chain given the traction. Unlike other protocols that aim to be the leading “insert protocol category” on Arbitrum, Optimism or the next L1/L2, we believe MYTH can be a standalone leader of Web3 gaming. Also, investors were concerned Bitensor had chosen substrate when it was $1B FDMV, and is now $15B FDMV, with a recent listing on Binance.

Execution. The thesis depends on Mythical successfully make the transition from 1P game studio to web3 gaming platform with focus on token. We believe John and team are well-equipped to lead this transition, especially with the backing of web3 native crypto funds advising him.

Lock up & Vesting. MYTH has suffered from sell pressure from vesting as the token launched in the bear from investors who invested in the equity business and received a token warrant. The vesting began in May 2023, when the token went from $1B to $200M. We believe the refocus on the token and bringing on new web3 investors will alleviate the vesting pressure, which will finish in May 2025. As mentioned, MYTH is focused on the token through MYTH 2.0 and on raising awareness given many investors knew of Mythical Games (the equity business) but not of MYTH (the token).

Special thanks to John Linden (Founder, Mythical), Santiago Santos (ex-ParaFi), Cosmo Jiang (Pantera), Jason Kam (Folius Ventures), Mable Jiang (STEPN, ex-Multicoin), Jack Sheng (DIG Games, ex-Tencent), Jarett Knapp (Doodles, ex-EA & Gala) and Angie Dalton (Signum Growth) for their review and input.

LEGAL DISCLAIMERS

THIS POST IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This post has been prepared by Modular Capital Investments, LLC (“Modular Capital”) and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. The information contained in this post is superseded by, and is qualified in its entirety by, such offering materials.

THIS POST IS NOT A RECOMMENDATION FOR ANY SECURITY OR INVESTMENT. References to any portfolio investment are intended to illustrate the application of Modular Capital’s investment process only and should not be used as the basis for making any decision about purchasing, holding or selling any securities. Nothing herein should be interpreted or used in any manner as investment advice. The information provided about these portfolio investments is intended to be illustrative and it is not intended to be used as an indication of the current or future performance of Modular Capital’s portfolio investments.

AN INVESTMENT IN A FUND ENTAILS A HIGH DEGREE OF RISK, INCLUDING THE RIKS OF LOSS. There is no assurance that a Fund’s investment objective will be achieved or that investors will receive a return on their capital. Investors must read and understand all the risks described in a Fund’s final confidential private placement memorandum and/or the related subscription posts before making a commitment. The recipient also must consult its own legal, accounting and tax advisors as to the legal, business, tax and related matters concerning the information contained in this post to make an independent determination and consequences of a potential investment in a Fund, including US federal, state, local and non-US tax consequences.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS OR A GUARANTEE OF FUTURE RETURNS. The performance of any portfolio investments discussed in this post is not necessarily indicative of future performance, and you should not assume that investments in the future will be profitable or will equal the performance of past portfolio investments. Investors should consider the content of this post in conjunction with investment fund quarterly reports, financial statements and other disclosures regarding the valuations and performance of the specific investments discussed herein. Unless otherwise noted, performance is unaudited.

DO NOT RELY ON ANY OPINIONS, PREDICTIONS, PROJECTIONS OR FORWARD-LOOKING STATEMENTS CONTAINED HEREIN. Certain information contained in this post constitutes “forward-looking statements” that are inherently unreliable and actual events or results may differ materially from those reflected or contemplated herein. Modular Capital does not make any assurance as to the accuracy of those predictions or forward-looking statements. Modular Capital expressly disclaims any obligation or undertaking to update or revise any such forward-looking statements. The views and opinions expressed herein are those of Modular Capital as of the date hereof and are subject to change based on prevailing market and economic conditions and will not be updated or supplemented. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

EXTERNAL SOURCES. Certain information contained herein has been obtained from third-party sources. Although Modular Capital believes the information from such sources to be reliable, Modular Capital makes no representation as to its accuracy or completeness. This post may contain links to third-party websites (“External Sites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites. These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Sites.