Investing in BOB (Build on Bitcoin)

Publish Date: May 1, 2024

Author: Nirmal Krishnan, James Ho

With the launch of BOB Mainnet today, we are excited to share our investment thesis in Build on Bitcoin (BOB), the first of its kind hybrid L2 that connects Bitcoin and Ethereum.

We invested in the seed round led by Castle Island Ventures, alongside Mechanism Capital, CMS Holdings, Bankless, Alliance DAO, and a collection of deeply principled Bitcoiner angels including Dan Held and Domo (BRC-20 creator).

Market Opportunity

Source: DefiLlama

BOB is focused on unlocking the largest asset base in crypto: Bitcoin. While Bitcoin continues to be crypto’s most important asset, its native chain has among the lowest deployment in DeFi TVL.

This is not to say that activity has been nascent. Over the last year, we’ve seen an explosion in on-chain activity on Bitcoin driven by BRC-20, Ordinals, and Runes mania. These innovations brought token standards common in other ecosystems (fungible / non-fungible) to the Bitcoin ecosystem.

While fungible token volumes remain volatile, Ordinals volume has been remarkably robust, with many collections now rivaling the market cap of top blue-chip Ethereum NFT counterparts.

Demand for assets secured by Bitcoin remains encouraging and we are continuing to see new and emergent use-cases for Bitcoin blockspace.

Bitcoin Scaling

DeFi penetration in Bitcoin has been nascent largely because of its primitive programming script. Natively, Bitcoin script is not Turing-complete, which prevents the deployment of common DeFi primitives such as AMMs, Lend/Borrow, and DEXs as smart contracts.

Source: Decrypt

Consequently, we’ve seen these DeFi primitives move off-chain – either to federated Bitcoin sidechains or to centralized counterparties like BlockFi and Celsius.

The lessons from the last crypto market cycle are clear: multi-sig bridges and centralized counterparties represent undue risk to market participants.

We contend that for DeFi on Bitcoin to truly blossom, a scaling solution must exist with the following properties:

Native EVM smart contract support (or a similar developer ecosystem with a high degree of abstraction and community)

Trustless bridging (for Bitcoin native assets)

Strong security guarantees (via Bitcoin)

BOB stands to implement all 3 properties and usher in the next stage for the Bitcoin ecosystem.

Team

When we met Alexei, we were extremely impressed by his technical expertise. Alexei and his co-founder Dominik are Bitcoin OGs, doctorates in computer science, and have been building in the space since 2015.

They are also extremely plugged in to innovation on the Bitcoin stack and can quickly leverage these innovations into their product. The team is the exact combination of commercial and technical that is needed to lead an ambitious product like this.

Unique Design

BOB is a new Bitcoin L2 that aims to bring full EVM compatibility, with its rich programmability and UX, to Bitcoin’s security and power. It aims to allow developers to deploy applications from existing EVM networks while leveraging native Bitcoin assets and liquidity.

While the long-term goal is clear, the BOB team is pragmatic and recognizes this is not possible in the near-term because of Bitcoin script’s lack of programmatically. Given the lack of Turing-completeness, it is not possible to evaluate fraud proofs on Bitcoin so building a traditional roll-up is not feasible today.

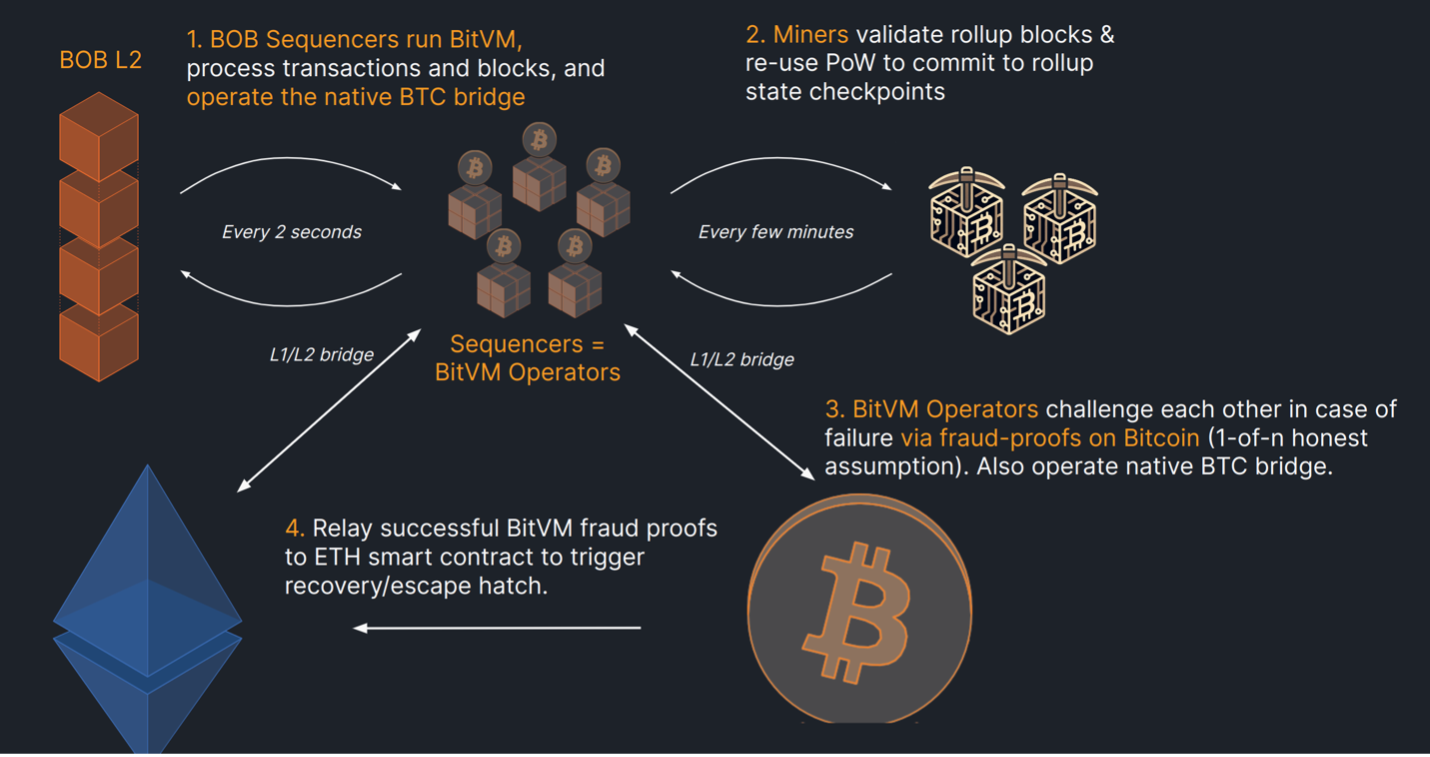

While there is reason to be excited by the recent advances of BitVM, a new computing paradigm that aims to bring fraud proof verification to Bitcoin, there is still not a live implementation. Consequently, BOB is planning a phased roll-out where they can initially leverage Ethereum’s security model, programmatically, and liquidity while eventually bringing the guarantees of Bitcoin’s security model.

Phase 1: Optimistic rollup to Ethereum (built on OP Stack) with a Bitcoin light client built into the sequencer

This enables a trustless bridge with Ethereum to bring stablecoins and ERC20 assets and some trustless communication with Bitcoin to enable cross-chain swaps, auctions, and contract executions. In terms of native BTC asset support, BOB plans to launch with the tBTC bridge, which provides a good trade-off of trust and liquidity.

Phase 2: Bitcoin PoW Merge Mining with Ethereum Optimistic Rollup

This enables stronger Bitcoin-native security guarantees as Bitcoin merge-miners now validate rollup blocks (in order to generate fees) and their commitments are now validated in the Ethereum L1 proof-verification contract. On an asset basis, this phase will still likely not have native BTC support despite the stronger PoW security guarantees.

Phase 3: Bitcoin Optimistic Rollup with Ethereum Rollup

By this phase, the expectation is BitVM is production ready, such that fraud proofs can now be natively verified on Bitcoin L1. This will bring much stronger PoW security guarantees as well as native Bitcoin asset support via trustless bridging. Ethereum bridged assets will continue to be verified on the Ethereum L1 contract such that ETH assets are secured by Ethereum and Bitcoin assets bridged to the rollup are secured by Bitcoin.

Ultimately, we believe this model will be the holy grail of Bitcoin scaling because it will have a robust developer experience, native bridging to both Bitcoin and Ethereum, and strong security guarantees.

Traction

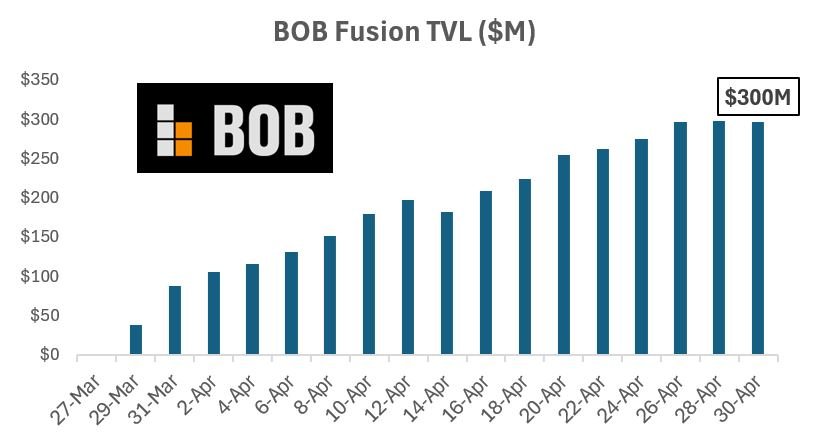

In terms of traction, BOB has launched its Spice Liquidity campaign, ahead of its mainnet launch. In less than a month of going live, this campaign has already attracted $300M TVL (~1/4 of total TVL deployed on Bitcoin) and growing steadily.

Source: Dune Analytics

We expect TVL to continue to inflect after mainnet launch for a few key reasons:

Numerous Ethereum dApps already announcing their deployment to BOB, including Velodrome, Frax Finance, Socket, and others

Mainnet will include familiar support for 350+ EVM wallets, block explorers, account abstraction, data analytics, and oracles

BOB will have wallet support for all the top Bitcoin wallets (Leather, Unisat, Xverse) to create a consistent environment for Bitcoiners making their foray into DeFi.

BOB is also planning to build a rollup ecosystem (like the OP stack) where it will license its technology to institutions and other Bitcoin L2s. Marathon Digital, one of the largest American Bitcoin miners, has already committed to building Alys, a Bitcoin side-chain focused on institutional demand and real-world asset tokenization atop the BOB stack.

We are excited to partner with Alexei and team as they continue to push the Bitcoin renaissance forward. BOB is continuing to build out its launch partners, so please get in touch and we would be happy to connect you with the team.

LEGAL DISCLAIMERS

THIS POST IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This post has been prepared by Modular Capital Investments, LLC (“Modular Capital”) and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. The information contained in this post is superseded by, and is qualified in its entirety by, such offering materials.

THIS POST IS NOT A RECOMMENDATION FOR ANY SECURITY OR INVESTMENT. References to any portfolio investment are intended to illustrate the application of Modular Capital’s investment process only and should not be used as the basis for making any decision about purchasing, holding or selling any securities. Nothing herein should be interpreted or used in any manner as investment advice. The information provided about these portfolio investments is intended to be illustrative and it is not intended to be used as an indication of the current or future performance of Modular Capital’s portfolio investments.

AN INVESTMENT IN A FUND ENTAILS A HIGH DEGREE OF RISK, INCLUDING THE RIKS OF LOSS. There is no assurance that a Fund’s investment objective will be achieved or that investors will receive a return on their capital. Investors must read and understand all the risks described in a Fund’s final confidential private placement memorandum and/or the related subscription posts before making a commitment. The recipient also must consult its own legal, accounting and tax advisors as to the legal, business, tax and related matters concerning the information contained in this post to make an independent determination and consequences of a potential investment in a Fund, including US federal, state, local and non-US tax consequences.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS OR A GUARANTEE OF FUTURE RETURNS. The performance of any portfolio investments discussed in this post is not necessarily indicative of future performance, and you should not assume that investments in the future will be profitable or will equal the performance of past portfolio investments. Investors should consider the content of this post in conjunction with investment fund quarterly reports, financial statements and other disclosures regarding the valuations and performance of the specific investments discussed herein. Unless otherwise noted, performance is unaudited.

DO NOT RELY ON ANY OPINIONS, PREDICTIONS, PROJECTIONS OR FORWARD-LOOKING STATEMENTS CONTAINED HEREIN. Certain information contained in this post constitutes “forward-looking statements” that are inherently unreliable and actual events or results may differ materially from those reflected or contemplated herein. Modular Capital does not make any assurance as to the accuracy of those predictions or forward-looking statements. Modular Capital expressly disclaims any obligation or undertaking to update or revise any such forward-looking statements. The views and opinions expressed herein are those of Modular Capital as of the date hereof and are subject to change based on prevailing market and economic conditions and will not be updated or supplemented. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

EXTERNAL SOURCES. Certain information contained herein has been obtained from third-party sources. Although Modular Capital believes the information from such sources to be reliable, Modular Capital makes no representation as to its accuracy or completeness. This post may contain links to third-party websites (“External Sites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites. These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Sites.