Our Braintrust Thesis

Publish Date: Nov 2, 2023

Author: Vincent Jow

Executive Summary

Braintrust is a web3 freelancer (“talent”) marketplace that connects nearly 3,000 companies with a network of 490,000 freelancers. Their customers include hundreds of large, global enterprise clients including Goldman Sachs, Walmart, Nike, Google, Meta and McKinsey. The network focuses on roles in software engineering, design, product management, with a recent expansion into marketing roles.

We believe Braintrust (BTRST) is undervalued with strong value accrual to the token. The protocol trades at $100M market cap, while doing ~$90M annualized of Gross Service Value (GSV) as of Q3 2023. BTRST charges a 15% markup, or 13% take rate equivalent. This translates to $11M of net revenue (9x revenue multiple) with GSV growing 225% from 2021 to 2022 [1]. For context, Fiverr and Upwork are publicly listed companies which trade at roughly 2-3x annualized revenue, growing revenue in the low-teens [2]. Braintrust also holds $45M in cash and uses 100% of their net revenue to buy back BTRST tokens.

Despite macro uncertainty, Braintrust’s core business has continued to demonstrate strong fundamentals. Their platform GSV has remained stable from 2H 2022 to 2023, despite significant layoffs in the technology sector and 50-75% hiring freezes within its enterprise customer base. Notably, the supply side has grown 5X from 94K to 490K over the past year with nearly 0 acquisition cost, benefiting from the layoffs in the tech sector. The company continues to actively ship new products, launching self-serve for SMBs in August 2023 which has led to over 1K net new customers and 10X growth in client job postings.

There is potential for Braintrust’s “Web3 LinkedIn” product to take off with the launch of the Professional Network, which we believe is not priced in. Launched in July 2023, the Professional Network builds a web3 social experience for professionals, such as allowing users to pay for mentorship with BTRST tokens and having token-gated discussions. Although the product is still in beta, there has been strong momentum, with 20-30K monthly active users (MAUs) of the product. Braintrust already has an installed base of 490K talent profiles, compared to leading web3 social platforms with 10-50K MAUs (Lens, Farcaster). If successful, Braintrust could build the largest web3 social network at scale.

We believe Braintrust GSV can increase from $100M to $1B once their enterprise customers start hiring again over an economic cycle. At a 20% take rate, this translates to $200M of net revenue and applying a 5x multiple yields a $1B market cap protocol. If the Professional Network is successful, that could also be worth another $1B. Combined, that would result in a nearly $2B market cap outcome. [3]

Market Overview

The rise of the digital economy over the last decade, the advent of work from home throughout COVID-19, and the Great Resignation, have all structurally enabled and accelerated the freelance economy.

Today the global freelance opportunity is estimated to be $1.3 trillion, with digital platforms only penetrating ~5% of this total addressable market (TAM). Globally there are estimated to be 225M remote knowledge workers registered on digital platforms. [4]

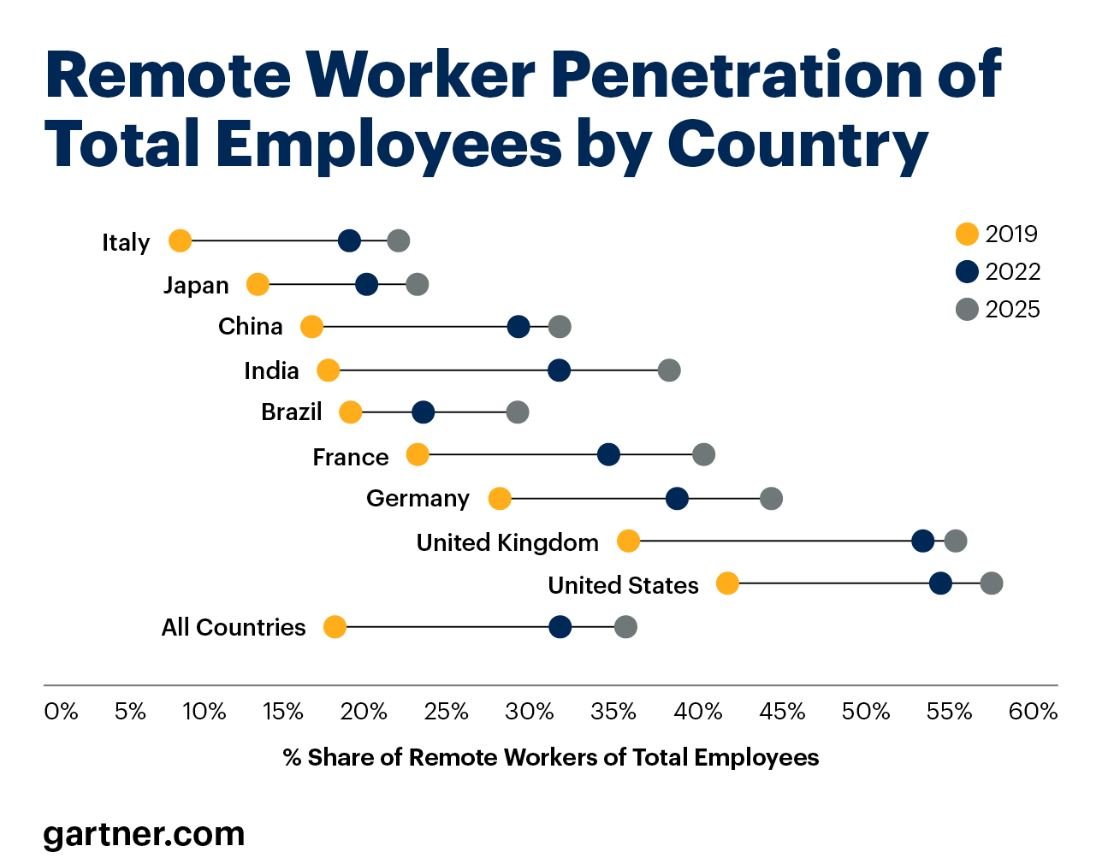

Gartner estimates 32% of knowledge workers to be remote in 2022, up from 17% in 2019. Some of the most developed markets including the US and UK have over 50% of their knowledge workers performing remote work.

Source: Gartner

In the US, we have seen a seismic shift in how Americans work. 36% of the US workforce is comprised of independent workers. While independent work exists across all ages, nearly 70% of GenZ consider freelancing a viable career option.

Freelancing has numerous benefits for both workers and employers. For workers, it provides additional flexibility, independence, and a broader range of professional experience. For employers, they are able to take advantage of a more globalized talent base (in many cases remote), reduce hiring costs, and align a more flexible cost structure for their business.

The first wave of gig economy platforms has led to huge outcomes across rideshare, food/grocery delivery, and home/apartment rentals. Uber, Lyft, DoorDash, Grab, Instacart and Airbnb, were all founded over a decade ago between 2008-2013. Today these platforms collectively contribute earnings to 19 million individuals, represent $200+ billion in market capitalization and $300+ billion of annualized GMV. [5]

Source: Public Company Financials and Annual Filings, KoyfinMore recently, we are seeing a new generation of digital freelance platforms increasingly target office roles which include software development, project management, design, accounting, finance and others. As was the case with taxi rides and food delivery, these roles were previously coordinated through inefficient, non tech-enabled means. Consumers used to dial a phone number to request a taxi dispatch or ask their local restaurant to deliver. Similarly, today the vast majority of freelance work for office roles are still coordinated through legacy staffing agencies.

To illustrate the size of this opportunity, Robert Half International (RHI) is an $8 billion publicly traded company, founded 75 years ago in 1948, that is one of the largest traditional staffing agencies. RHI generated $7.2 billion in 2022 revenue, growing double digits annually, with 43% gross margins (according to their 2022 10-K filing). This means RHI applies a 75% markup to wages paid to the 164,200 workers they placed in 2022. The staffing process is facilitated through manual means with over 9,000 full time employees (excluding those which are billed out to clients for professional engagements).

As with the rest of the internet economy, digital marketplaces collapse these inefficiencies, allowing workers to get paid more while driving cost reductions for employers, and further unlocking the full potential of the freelance economy.

Braintrust Overview

Braintrust is a web3 talent marketplace founded in 2018. Their platform connects some of the world’s largest companies (Goldman Sachs, Walmart, Nike, Google, Meta, McKinsey) with their network of 490,000 freelancers. Since inception, Braintrust has raised over $120 million in funding from both crypto funds (Multicoin, Variant, Galaxy Digital, Pantera) and traditional tech hedge funds and venture funds (Tiger Global, Coatue).

Source: Braintrust Website as of October 29, 2023 On the talent (supply) side, the majority of Braintrust’s talent base consists of approved engineers (35%), followed by designers (20%), and product (11%). Approximately 70% of the talent on Braintrust holds 7+ years of experience, with 50% based in the US and 50% international.

Over the past year, talent profiles on their platform have grown 5x from 94K (Oct 2022) to 490K today. Braintrust’s supply side has benefited from the roughly 400K tech layoffs over the last two years. The cost of acquiring talent on the network has reached close to 0.

Source: Braintrust Network Dashboard; based on Modular Capital’s tracking of website data at month-end for displayed number of talent profiles (“Community Members”)Importantly, Braintrust has rapidly bootstrapped and scaled its network by leveraging web3 incentives via referrals. Individuals can refer clients through the Braintrust Connector Program, earning 2% of the total contract value for each individual that employer hires, or refer freelance workers (talent) of which they receive 1% of their future earnings. Both of these are capped at $100,000 on a per enterprise or talent basis. This creates a community-built and owned model where contributors to Braintrust (either on the client/demand or talent/supply side) share in on the upside and growth via the BTRST token.

Source: Braintrust Talent All-Hands Video from August 2023On the client (demand) side, Braintrust has a diversified base of nearly 3,000 customers, spanning across all major industries. The largest industries include internet (21%), information and technology services (13%) and computer software (13%) with clients such as Google, Airbnb, Meta, Pinterest, Shopify and Dropbox.

Braintrust also has a significant client base in more traditional sectors, including automotive (Honda, Porsche), financial services (Bank of America, Goldman Sachs), retail (Nike, Walmart), CPG (Nestle, Pepsi), insurance (Pacific Life, Guardian) and consulting firms (Deloitte, McKinsey).

Below highlights some of the most active companies on the platform:

Source: Braintrust Jobs Portal [**]Braintrust has recently looked to expand from its large enterprise focus into SMBs (Small and Midsize Business). In August 2023, Braintrust launched its self-serve product, which allows customers to sign up without talking to a company rep. Self-serve has resulted in a 10x increase in job postings, and 1K net new clients from their expansion down market.

Source: Braintrust Talent All-Hands Video from August 2023 [**]Braintrust largely competes with legacy staffing firms, consulting firms, and agencies. Braintrust jobs are generally large projects and long engagements, with the average annual client spend of $260K and taking 228 days.

Legacy competitors typically take weeks to vet and staff the right person and charge 20-75%+ markup because of centralized points of coordination. Braintrust is able to quickly vet candidates (<48 hours) within its large pool of established candidates and fill candidates in a short period of ~2 weeks through its open and distributed platform.

Notably, Braintrust charges a far cheaper markup of 15% on customer spend that flows through its platform (this recently increased from 10% in July 2023). This fee is entirely charged to clients as a markup, with 0% fees taken from the talent side. Braintrust’s rate of 15% is up to 5x cheaper than what they would pay to legacy incumbents. Braintrust has abstracted away the web3/crypto elements from its customers, who make the payment (inclusive of this 15% fee) to Braintrust through traditional payment methods of ACH, wires, credit cards, and has integrations with bill pay platforms like Bill.com.

The 15% markup that Braintrust applies (equivalent to a 13% take rate on GSV) is then used to buyback tokens in the open market. This returns value to owners of the network, which include many of the individuals who first recruited companies and talent to its network to support its growth.

Competitive Landscape

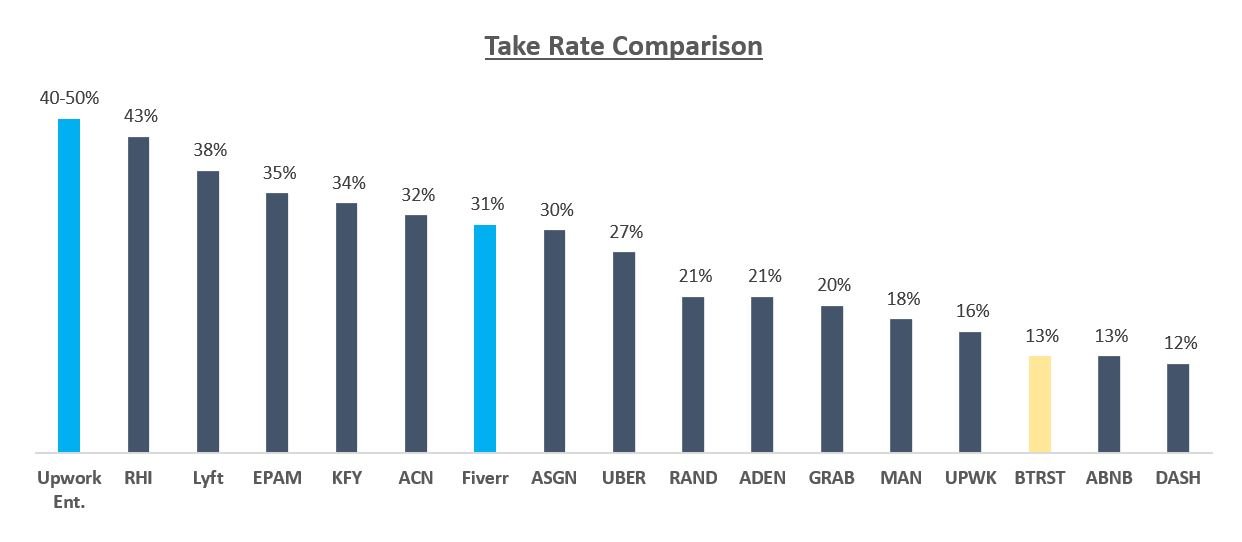

Historically, Upwork and Fiverr have been used as comparisons to Braintrust given they are both tech-enabled ecommerce talent marketplaces and publicly listed.

Upwork is valued at $1.4B market cap with $4B+ of annualized GMV. Fiverr is valued at $800M market cap with $1B+ in annualized GMV. Both of these illustrate the large market opportunity that Braintrust is addressing and tackling.

However, there are key differences between these platforms:

Fiverr is fully SMB, with the average spend per buyer at $277. They take 20% of the freelancer earnings, with additional charges for the customer which blends to a 31% take rate on GSV.

Upwork is largely SMB, with only 8% of its revenue from enterprise clients. Upwork’s average GSV per customer is $5K (or only 2% of BTRST’s $260K). Upwork has an overall 16% take rate on GSV. Upwork’s enterprise plans are upwards of 40%+ take rate.

Braintrust is significantly higher upmarket than either Fiverr or Upwork.

Source: Fiverr Q2 2023 Investor Letter, Upwork Q2 2023 Investor Letter, Braintrust Network DashboardWe believe the better comparison is Robert Half, a $8 billion market cap traditional workforce and staffing provider that is focused largely on the accounting sector. Notably, Braintrust’s TAM of software engineers is 2x the size of Robert Half’s accountants. [6]

Robert Half has been able to get to roughly 6% penetration of its category, whereas Braintrust is < 0.1% penetrated. Robert Half has 43% gross margins (equivalent to 75%+ markup on talent) demonstrating continued pricing power for Braintrust currently at 13% take rate.

Illustratively, if Braintrust were able to penetrate 5% of its TAM, that would generate $12.5B GSV and at a 20% take rate be $2.5B revenue. At a 3x revenue multiple, that would be a $6B market cap outcome.

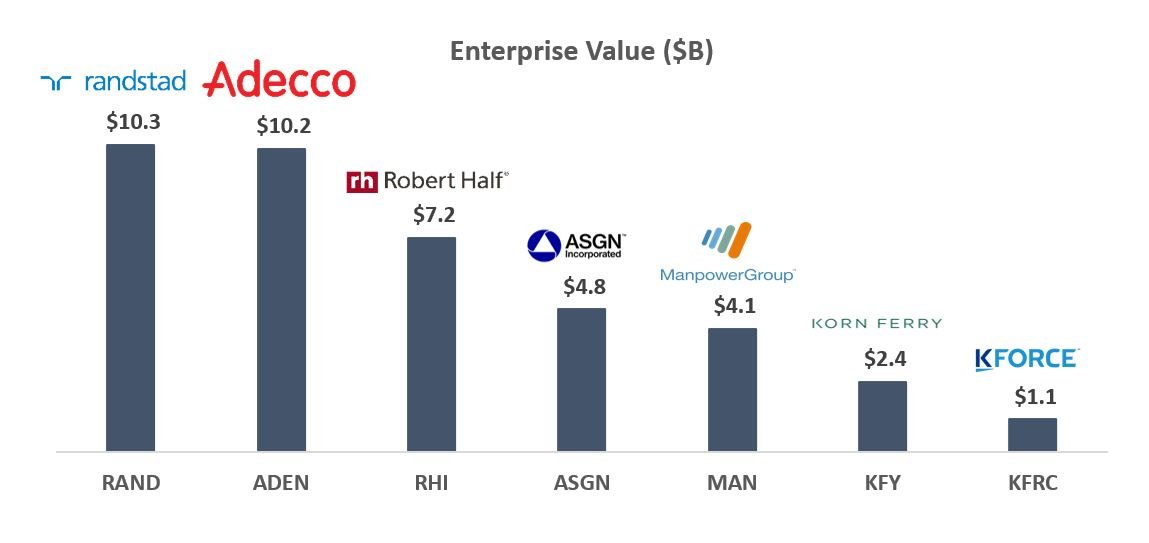

Source: Robert Half Investor Presentation, Braintrust Network Dashboard, Bureau of Labor StatisticsWhile we have chosen to focus on Robert Half and the accounting sector, there are many other publicly traded traditional staffing companies, collectively worth >$40B in market cap. For example, Randstad focuses on the HR industry, with ~1M candidates placed in 2022. Manpower focuses on lower-skilled workers, having placed millions of contractors in 2022.

Source: Koyfin, as of October 27, 2023 [**]We believe Braintrust has significant pricing power. When looking across the competitive landscape for staffing and consulting firms, the more specialized providers are able to charge a significantly higher take rates. As mentioned above, Robert Half focuses on accountants and is able to charge a 43% take rate. EPAM specializes in technology and charges 35%. Accenture, one of the leading consulting firms, is able to charge 32%. On the other hand, Manpower, Adecco and Randstad focus on lower-skilled workers and have is able to only charge 18-21%.

Across internet marketplaces, we see a wide range of take rates, between 12-38%.

While Upwork and Fiverr have 16% and 31% take rates respectively, Upwork Enterprise is 40%+ take rate, again showcasing that highly specialized talent for enterprises is able to command a premium take rate.

Notably, there has been little change in volumes or pushback from customers after the 10% to 15% markup increase Braintrust implemented in July 2023 (equivalent to 9% to 13% take rate increase on GSV).

Source: Koyfin, street estimates and company filings [7]Braintrust Professional Network

In July 2023, the company rolled out the Braintrust Professional Network, a “Web3 Linkedin”. Similar to other social products, there is a customized feed where users can see what people are discussing and post content of their own – around industry specific topics, resume reviews, career advice, and navigating new opportunities and roles.

Over time, Braintrust is looking to incorporate token experiences, which includes paying or tipping for mentorship with BTRST tokens, or having curated, token-gated discussions. In just a short period, the Professional Network has grown to 20-30K MAUs with 1-7 minutes of website engagement. [8]

We believe there can be powerful synergies between Braintrust’s freelance marketplace and the Professional Network. Today, the talent marketplace, with its 490K installed base of users, will likely be the driver of growth for the Professional Network. Over time, the Professional Network could become an additional top of the funnel for the talent marketplace.

An example of how we could see the professional network grow its user flywheel:

Job seekers today use the Professional Network to ask for help on their Braintrust profiles and resume to improve their chances of receiving interviews.

Contributors and mentors over time could monetize their experience through providing advice, in addition to the revenue they earn on the marketplace. Leading contributors and mentors can earn badges from the community, which could also help employers evaluate potential prospects on the job marketplace.

Employers can also get involved in the Professional Network, with helpful workshops and free mentorship opportunities, which would increase their attractiveness and provide a funnel back to their postings on the marketplace.

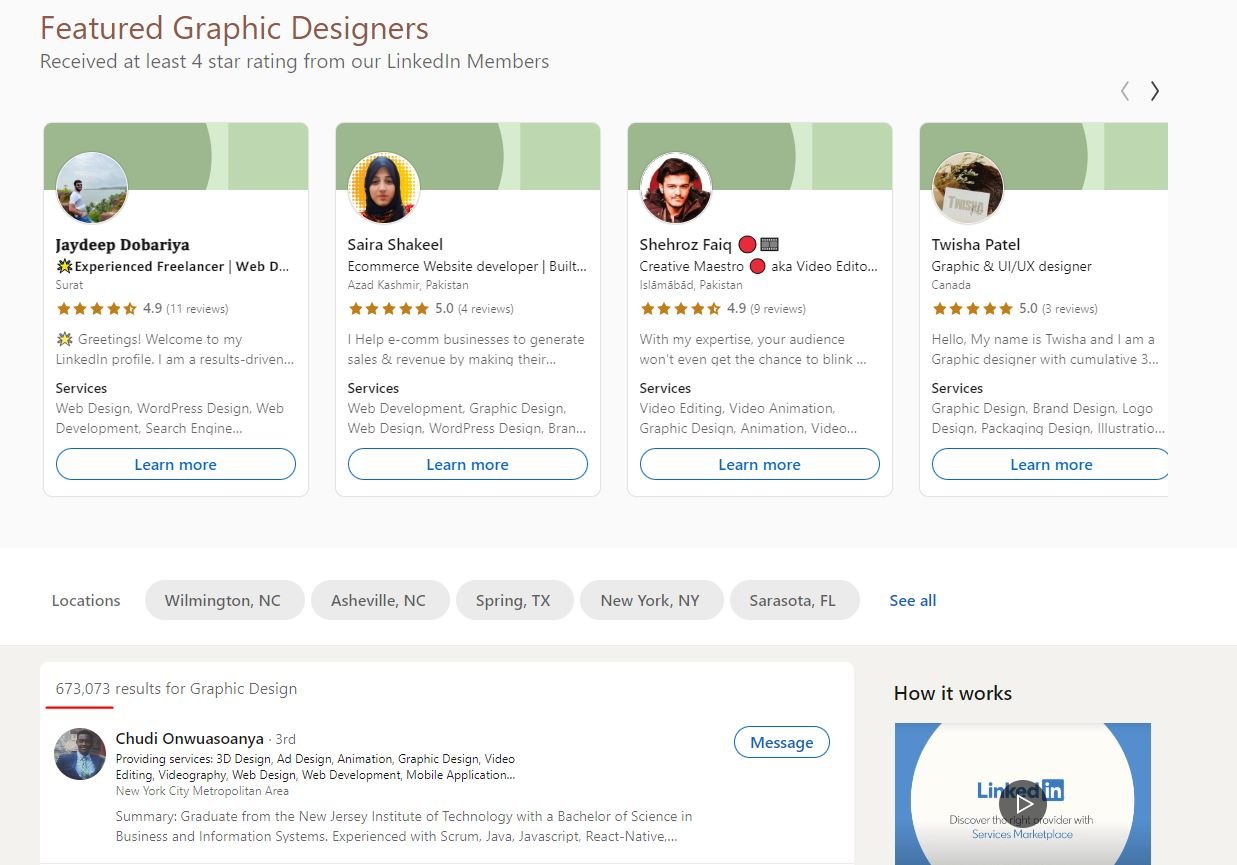

Source: Braintrust Talent All-Hands Video from August 2023In October 2021, LinkedIn rolled out a freelancer marketplace, which we believe is a validation of the strategic nature of combining a social network with a freelance marketplace. However, the execution has been mixed. The #1 popular service of Graphic Design yields a choice of 8 Graphic Designers with 1-11 reviews and then the opportunity to message 675K LinkedIn profiles which has listed “Graphic Design” somewhere in their profile. This uncurated approach to building a talent marketplace creates a bad user experience for both the enterprises and talent.

When comparing Braintrust against the leading Web3 social platforms, Braintrust has 3.8x more profiles and 10x MAUs versus Lens Protocol. Given the installed base of 490K talent and flywheel Braintrust could create, if the Professional Network were successful, it could quickly become the leading social platform in Web3 at scale.

Source: Lens (Dune Analytics), Farcaster Website, Braintrust Network Dashboard, Semrush as of October 29, 2023Financial Metrics

Since its founding in May 2018, Braintrust has rapidly grown. The company scaled GSV from $3M in 2020, to $26M in 2021, and $86M in 2022. For perspective, Upwork took nearly a decade to scale to $100M GSV for their talent marketplace [9], and Fiverr crossed $10M in monthly GSV in its 6th year in business. [10]

Source: Braintrust Network Dashboard, Upwork and Fiverr public financialsDespite the significant tech layoffs, which started in Q1 2022, Braintrust has been able to largely maintain its GSV. Today, 50-75% Braintrust’s enterprise customers are on complete hiring freezes, which has resulted in GSV remaining flat over the last 7 quarters.

Source: Braintrust Network Dashboard, Layoffs.fyiAlready, we are starting to see a recovery in the number of jobs being added in Q3 2023, which has rebounded to 70% of early 2022 levels after troughing at 50%. The consistency of GSV despite macro headwinds showcases continued strong customer sign ups and continued share gain from competitors.

Source: Braintrust Network DashboardValuation & Scenario Analysis

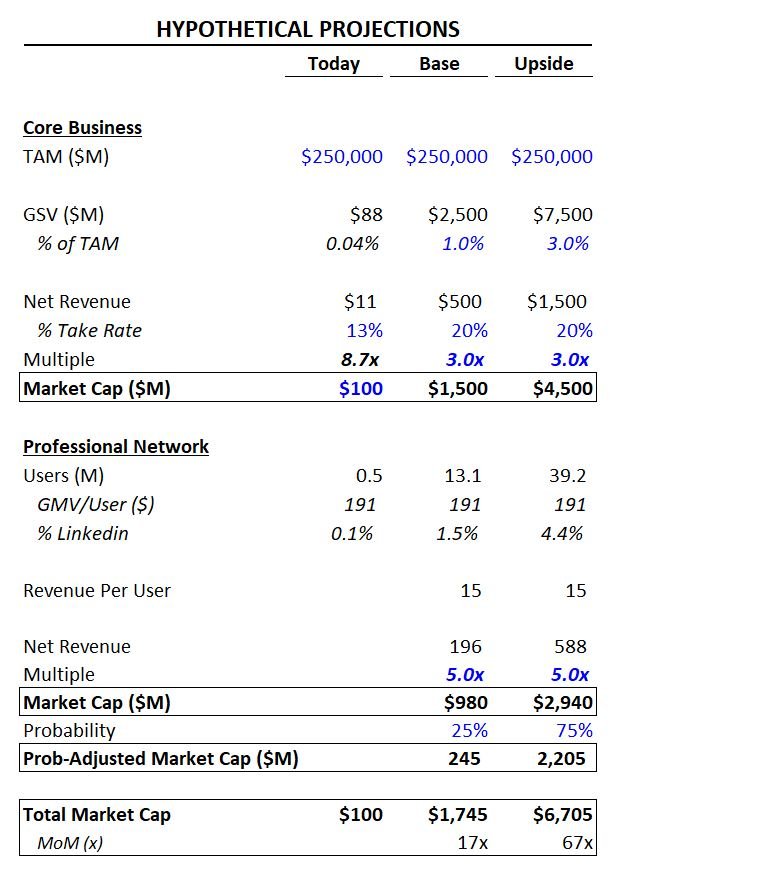

Below, we present a few scenarios and illustrative assumptions for Braintrust’s key drivers.

Base Case:

TAM: We assume Braintrust penetrates 1% of the US software developer TAM of $250B, which translates to $2.5B of GSV. For context, RHI has penetrated 6% of the US Accounting TAM of $120B.

Take Rate: We believe Braintrust has further upside to take rate, with RHI earning 43% gross margins and Upwork charging 40%+ on its enterprise plans. We conservatively assume take rate can increase from 13% to 20%. This results in $500M of net revenue.

Multiple: Given RHI, FIVR and UPWK all trade around 3x net revenue (on 1-year forward), we assume a 3x net revenue multiple as well which yields $1.5B of market cap.

Call Options: For either of our cases, we do not assume any penetration of other freelance markets ($1T+ GSV opportunity), which would include international and other job verticals. Braintrust has also started a direct placement product for full time hiring last summer, which we do not assume in either of our cases.

For Professional Network, we apply a similar GMV per User to get a rough estimate on how many users would be onboarded on the marketplace. Over time, we believe the professional network can become the top of the funnel for the talent marketplace. In our base case we assume the professional network gets to 15M users, which is only 1-2% of LinkedIn’s 900M users. LinkedIn users monetize at ~$15 per user. As we have seen in Web3 examples, when you add tokens and ownership, we have seen engagement and monetization go up significantly, even though we do not assume it here. In our base case, the Professional Network generates $200M of revenue. Using 5x revenue, which is in-line for average for Web2 social platforms, this results $1B of market value. Given this is an unproven product, we assume 25% probability of success, resulting in $250M of additional market value.

Valuation: In our base case, we arrive at $1.5B valuation for the core business and $250M for the Professional Network, or 17x upside from here. For context, Fiverr and Upwork are $1-2B market cap companies, which simply means Braintrust grows into the outcome size of its existing peers.

Upside Case: Our upside case uses the same framework as our base case. We assume increased penetration from 1% to 3% in the core business. For the Professional Network, we assume a higher chance of success and gets to 5% of LinkedIn users. This results in $4.5B for the core business and $2.2B for the Professional Network, or a ~$7B market cap company overall. For context, RHI is a $8B market cap company and LinkedIn was acquired at $26B in 2016 (estimated to be $50-70B when adjusted for user and revenue growth) [11]

Downside Case: Given crypto is so convex in its returns, the focus is usually on the upside. However, given Braintrust is a real business with fundamentals decoupled from crypto, it does make sense to show what we think is limited downside. As a reminder, Braintrust has $45M of cash on its balance sheet. Assuming no growth from here ($90M GSV) and a re-rate down to peer comps (3x), this would be $35M market cap (65% downside from here). If you give them credit for the cash, this would be $80M market cap (15% downside from here).

Disclaimer: All forecasts, assumptions, and performance metrics are hypotheticalRisks & Mitigants

Fundamentals decoupled from crypto. Given fundamentals are decoupled from crypto, Braintrust is less exposed to crypto beta and more dependent on execution. However, if the Professional Network is successful, this likely causes a re-rate in the multiple.

Recession risk. In the event of a major recession, this would hurt Braintrust’s business and fundamentals. However, given 50-75% of enterprise clients are already hiring freezes and the tech sector has laid of nearly 400K workers, Braintrust has already been in a “tech recession” over the last two years. Furthermore, staffing companies and consultants are always first to see cuts during recession so Braintrust potentially has already seen the impact of a recession.

Vesting and Sell pressure. Early token purchasers had 22% of the supply and had just finished vesting as of August this year. They were likely the primary cause of the sell pressure over the last few years. Early contributors, which have 19% of the supply, have only vested 40% of their share. Tiger Global and Coatue’s investment from December 2021 is still vesting as well, with 3% of the 5% continuing to vest.

There is ~85% circulating with ~15% of the supply still vesting at around 9% per year. While we believe the remaining investors are long-term holders, Braintrust is also buying back 11% of the supply at the current price.

Post vesting and in-steady state, the rewards for referrals are only about 1% against 15% buy pressure from fees. Furthermore, we believe the Professional Network will create additional token sinks to the network through utility of the token.

Given 54% of Braintrust tokens are being allocated for community rewards, there is the academic argument that Braintrust market cap should be calculated excluding this pool of tokens. Given the community rewards will be drained at <1% of GSV and refilled at 13% of GSV, the base of community rewards will only continue to grow. Using this calculation, Braintrust trades at $45M market cap, especially compelling when against $45M of cash on the balance sheet.

Special thanks to Adam Jackson (Co-Founder/CEO, Braintrust), Anne Muscarella (Head of IR, Braintrust), Will Scheinman (Road Capital), Cosmo Jiang (Pantera Capital), Nirmal Krishnan (Artemis Analytics) for their review and input.

[1] Revenue estimate uses $88M of Q2 2023 annualized GSV with a 15% markup (equivalent to 13% take rate). GSV is from Braintrust Network Dashboard and includes fees. Braintrust had GSV of $86M in 2022 and $26M in 2021, which implies 225% growth.

[2] Using enterprise value of $1.4B for Upwork and $1B for Fiverr, calculated as of October 27, 2023. Revenue runrate is based on Q2 2023 which would be $674M for Upwork and $358M for Fiverr.

[3] All forecasts and assumptions are hypothetical. See “Valuation & Scenario Analysis” section for details

[4] Market stats from Upwork June 2021 Investor Day

[5] Market capitalization as of October 27, 2023 (from Koyfin). GMV based on Q2 2023 run-rate. Total individuals with earnings are broken down as roughly 5.4M Uber drivers and couriers (as of Q4 2022), 2M Lyft drivers (as of October 29, 2023 website), 5M Grab Drivers (as of Dec 2020), 4M Airbnb Hosts (as of October 29, 2023 website), 2M DoorDash Dashers (as of Q1 2021), 600K Instacart shoppers (as of Aug 2023 S-1 Filing)

[6] Based on Bureau of Labor Statistics estimated for software engineer and accounting/audit roles, and average salary. Software engineers have total earnings of $250 billion vs accounting/audit of $121 billion.

[7] For consulting companies and outsourcers, RHI, KFY, ACN, ASGN, ADEN, RAND, MAN calculates take rate as Gross Profit / Revenue.

For internet marketplace companies, similar methodology with Marketplace Volumes / Revenue

Lyft bookings is street estimates from Koyfin, Uber is mobility bookings and revenue, Grab is GMV and revenue, Airbnb is GBV and revenue, Dash is Marketplace GOV and revenue, Fiver is GMV and revenue, Upwork is GSV and revenue. Upwork Enterprise is based on estimated Compliance package with 30% charge to clients and 10% to freelancers with $3K subscription per month

All metrics are from 2022, except EPAM 2021 numbers used given impact of Russia/Ukraine war

[8] Semrush data from June to September 2023. MAU is measured in unique visitors

[9] From Upwork S-1. Upwork was formed from the merger of Elance and oDesk in 2014. Elance was founded in 1998 and surpassed $100M annual GSV in 2010 (12 years). oDesk was founded in 2003, and surpassed $100M GSV in 2011 (8 years).

[10] From Fiverr IPO Prospectus. Fiverr was founded in February 2015, and crossed $10M in monthly GMV in 2015, its 6th year in business.

[11] Microsoft acquired LinkedIn for $26 billion in 2016. Users have doubled from 450M to 930M from the time of the acquisition. If the market capitalization per user were held constant, this implies >$50 billion of market value for LinkedIn today. LinkedIn is also estimated to have ~$14.5 billion of 2022 revenue. Applying an average multiple of 5x revenue for software/advertising comps translates to >$70 billion in market value.

[**] Logos are protected trademarks of their respective owners and Modular Capital disclaims any association with them and any rights associated with such trademarks.

LEGAL DISCLAIMERS

THIS POST IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This post has been prepared by Modular Capital Investments, LLC (“Modular Capital”) and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. The information contained in this post is superseded by, and is qualified in its entirety by, such offering materials.

THIS POST IS NOT A RECOMMENDATION FOR ANY SECURITY OR INVESTMENT. References to any portfolio investment are intended to illustrate the application of Modular Capital’s investment process only and should not be used as the basis for making any decision about purchasing, holding or selling any securities. Nothing herein should be interpreted or used in any manner as investment advice. The information provided about these portfolio investments is intended to be illustrative and it is not intended to be used as an indication of the current or future performance of Modular Capital’s portfolio investments.

AN INVESTMENT IN A FUND ENTAILS A HIGH DEGREE OF RISK, INCLUDING THE RIKS OF LOSS. There is no assurance that a Fund’s investment objective will be achieved or that investors will receive a return on their capital. Investors must read and understand all the risks described in a Fund’s final confidential private placement memorandum and/or the related subscription posts before making a commitment. The recipient also must consult its own legal, accounting and tax advisors as to the legal, business, tax and related matters concerning the information contained in this post to make an independent determination and consequences of a potential investment in a Fund, including US federal, state, local and non-US tax consequences.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS OR A GUARANTEE OF FUTURE RETURNS. The performance of any portfolio investments discussed in this post is not necessarily indicative of future performance, and you should not assume that investments in the future will be profitable or will equal the performance of past portfolio investments. Investors should consider the content of this post in conjunction with investment fund quarterly reports, financial statements and other disclosures regarding the valuations and performance of the specific investments discussed herein. Unless otherwise noted, performance is unaudited.

DO NOT RELY ON ANY OPINIONS, PREDICTIONS, PROJECTIONS OR FORWARD-LOOKING STATEMENTS CONTAINED HEREIN. Certain information contained in this post constitutes “forward-looking statements” that are inherently unreliable and actual events or results may differ materially from those reflected or contemplated herein. Modular Capital does not make any assurance as to the accuracy of those predictions or forward-looking statements. Modular Capital expressly disclaims any obligation or undertaking to update or revise any such forward-looking statements. The views and opinions expressed herein are those of Modular Capital as of the date hereof and are subject to change based on prevailing market and economic conditions and will not be updated or supplemented. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

EXTERNAL SOURCES. Certain information contained herein has been obtained from third-party sources. Although Modular Capital believes the information from such sources to be reliable, Modular Capital makes no representation as to its accuracy or completeness. This post may contain links to third-party websites (“External Sites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites. These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Sites.