Our Across Thesis

Publish Date: Nov 20, 2023

Author: James Ho, Vincent Jow

Executive Summary

Layer 2’s (L2s) are the primary way in which Ethereum will scale, and there will likely be both a proliferation and fragmentation of L2s. As L2s continue to attract more usage and activity (having recently flipped Ethereum transactions in 2023), bridges will play an increasingly important role and accrue more and more value. The bridging market is $60B annualized volume today, which represents under 10% of spot DEX volumes and we expect this percentage to grow significantly.

Across, due to its unique architecture, provides the cheapest (up to 75% cheaper) and the fastest (up to 90% faster) bridge experience on the market today in most major bridging routes. While most bridges have local pools on each chain to provide liquidity, Across aggregates liquidity in a main pool on Ethereum, relies on a network of relayers to front user liquidity, and then batches reimbursements through UMA’s optimistic oracle and canonical bridges. This allows for greater capital efficiency, lower gas fees (via batching and centralizing smart contract logic) and faster bridge speeds.

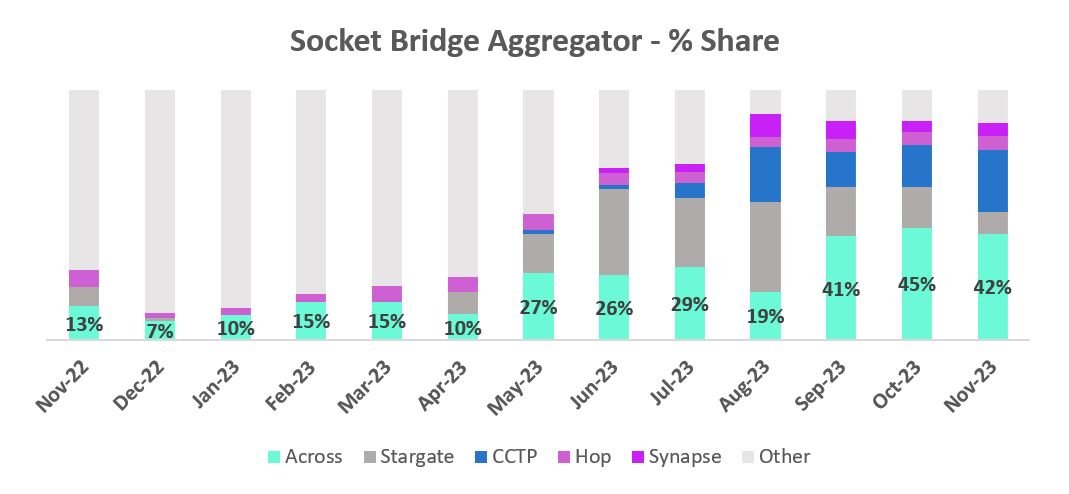

Today, on a headline basis, Across has 25-30% of the third party bridging market and 10% of the overall bridging market. When examining aggregator market share, Across has closer to 40-50% market share of the 3P bridging market. We believe that Across can continue to grow its share over time as aggregators surface bridges with the most competitive rates and speeds, benefiting from this structural tailwind.

Illustratively, if bridging volumes 5-10x from $60B to $300-750B due to increasing L2 activity and Across increases its share from 30% to 40-50% (Across’ share of aggregator volumes today already), that results in $60-250B in annual Across volumes. At a 5bp protocol take rate this would result in $30-125M of fee revenue to the protocol. Applying a 20x multiple results in a $600M-$2.5B market cap outcome. [1]

Market Overview

In the last cycle, Ethereum failed to scale with the large influx of users and transaction costs routinely hitting hundreds of dollars per transaction. Ethereum is capped at roughly 1 million transactions a day given its 15 million gas target per block, which translates into 11-12 transactions per second (TPS). This gave birth to the alternative Layer 1s, which optimized for speed and low transaction costs, while compromising on decentralization and/or security. Blockchains like Solana, Avalanche, Binance Smart Chain and Cardano hit 20-50% of Ethereum’s market cap.

In response to congestion issues, Ethereum has been focused on increasing scalability. In September 2022, Ethereum completed “the merge”, which transitioned Ethereum from Proof-of-Work to Proof-of-Stake. Ethereum has also been working on “the surge”, to increase throughput and reduce transaction fees. Key to the surge is the focus on rollup and Layer 2 (L2) scalability.

Over the course of 2022 and 2023, we have seen the rise of Ethereum L2s such as Optimism, Arbitrum, zkSync and others. In March 2023, we saw the major L2s flip Ethereum in number of transactions and is currently doing 2.5-3x the transaction volume vs Ethereum.

Source: Artemis Analytics; Major L2’s include Arbitrum, Optimism, Polygon zkEVM, Starknet, zkSync, Base [**]

Rollups move computation off-chain from Ethereum, handling transaction execution and state transitions on their own blockchain (the Layer 2). Once the transactions are finalized after a fraud dispute window (for optimistic rollups) or a zero knowledge proof (for zk rollups), Ethereum itself stores the merkle root (a repeated hash of all the account balances on the rollup) along with all transaction data as calldata (data availability). Ethereum itself is able to trustless reconstruct user balances and state should the L2 rollup blockchain be compromised, as it has the full history of user transactions. From a user perspective, they are able to have far cheaper transaction fees on the L2 by a factor of 10-20x, while maintaining the security guarantees of Ethereum and trustless bridging of assets.

Source: https://l2fees.info/ (screenshot on November 19, 2023 around 16:30 UTC)

Over the next few months or quarters, Ethereum will be introducing EIP-4844 upgrade, which introduces a new transaction type called a “blob”. This is estimated to reduce the cost of posting transactions to Ethereum by a factor of 10-100x, replacing call data (permanent storage and expensive) with blobs (transient storage) which is pruned after 2 weeks, just long enough for fraud dispute windows to finalize for optimistic rollups, and for all key actors to retrieve this data. This will further reduce transaction costs on L2s/rollups for users, and advance Ethereum’s scaling roadmap. Ethereum also continues to work on full danksharding, which could reduce data availability costs by another factor.

Within the generalized Layer 2 landscape, there are a handful of leading players, such as Optimism, Arbitrum, Polygon, zkSync and Starkware. There are also several new L2s yet to launch, including Scroll, Linea, Celo, etc. In addition to this, we are also seeing the rise of application specific L2s. In Optimism alone, we’ve seen the likes of Coinbase (largest US spot exchange with 100M+ users), Binance (largest crypto exchange globally with 150M+ users), Worldcoin (identity platform with 1-2M users), Aevo (options protocols) all develop their own L2s based on the Optimism technology stack.

With an increasing fragmentation of L2s, we believe increasing value will accrue to bridges between L2s. Users have a finite amount of assets and capital, which are used in a variety of applications across L2 chains. Optimistic rollups (Optimism, Base, Arbitrum) have a 7-day delay window if users withdraw through the canonical bridge, a wait time far too long for most users to tolerate. ZK-rollups (zkSync, Polygon zkevm) while still nascent, often have 15-60+ minutes wait windows through the canonical bridge, due to the periodic schedules zk-proofs are generated (which are expensive today, so can only be done every so often). In contrast, third party bridges are able to process asset movement across L2 chains in as little as 1 minute, for a very small fee.

Today, the bridging market facilitates roughly $60 billion of volume annually, which is about 9% of the spot DEX market.

Source: Defi Llama

Introduction to Across Protocol

Across Protocol launched in November 2022 after being incubated by UMA Labs. Across introduced a new model to bridge design, leveraging intents and a network of relayers.

Bridges have historically required capital on all chains they connect to with isolated liquidity pools for each asset on each chain. This has resulted in fragmented liquidity, leading to high bridging costs for users.

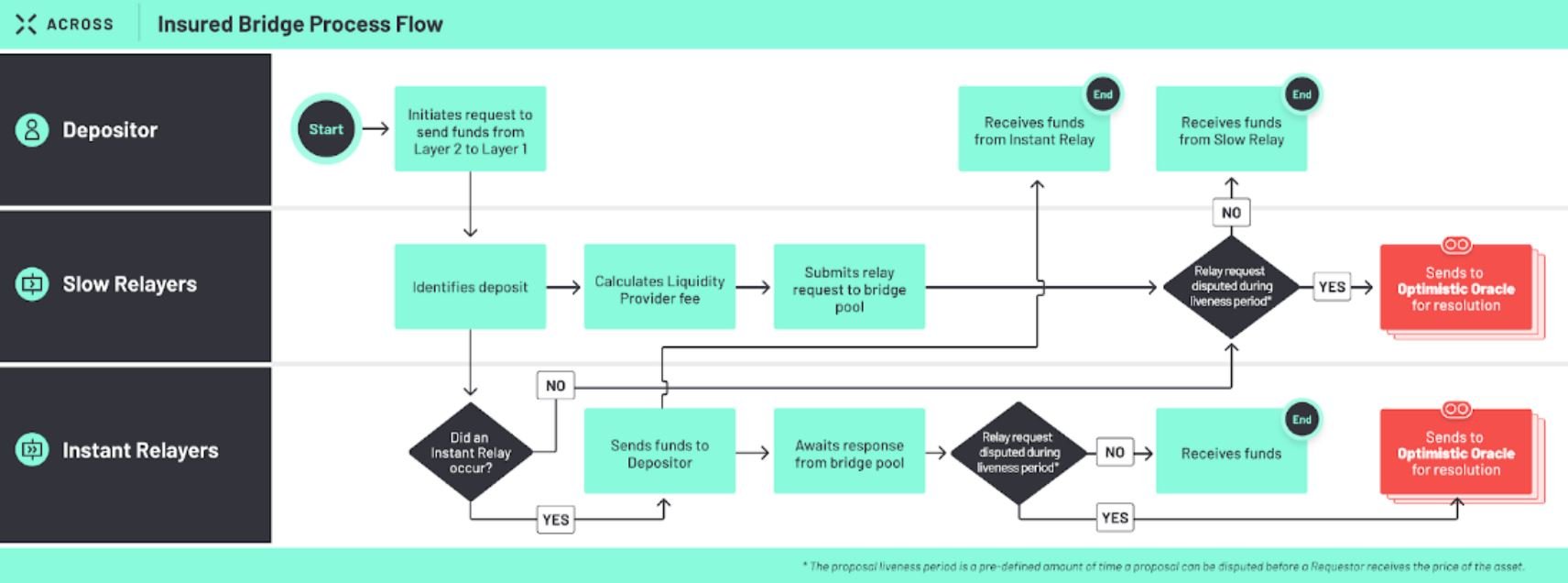

Across solved this problem by unifying liquidity with one pool on Ethereum mainnet. Instead of relying on local pools on each Layer 2 chain for liquidity, Across has a network of relayers. These relayers view the user deposits on the source chain, and once verified, compete to provide funds to the user on the destination chain. Afterwards, relayers submit a proof to UMA’s Optimistic Oracle, and is reimbursed, taking on the finality risk and delay.

This model leads to incredibly fast and capital efficient bridge transfers. More recently the industry has begun to call this an “intent-driven” bridging model.

Source: Across Docs (as of November 18, 2023)

UMA’s Optimistic Oracle works with a generalized escalation game:

An asserter first posts a bonded assertion about some state of the world (e.g. relayer requesting a reimbursement from the Across liquidity pool).

There is a challenge period, during which disputers are allowed to post bonds, and submit a dispute to the UMA DVM (Data Verification Mechanism).

If a dispute is submitted, then the DVM dispute arbitration voting process begins, with a 48-96 voting period.

UMA token holders (who are required to stake) will each independently vote on the outcome.

Votes are aggregated. UMA stakers who voted in the minority camp are slashed, with their stake re-assigned to stakers who voted correctly

The cost of corrupting the DVM requires obtaining 51%+ of UMA tokens.

Source: UMA Docs

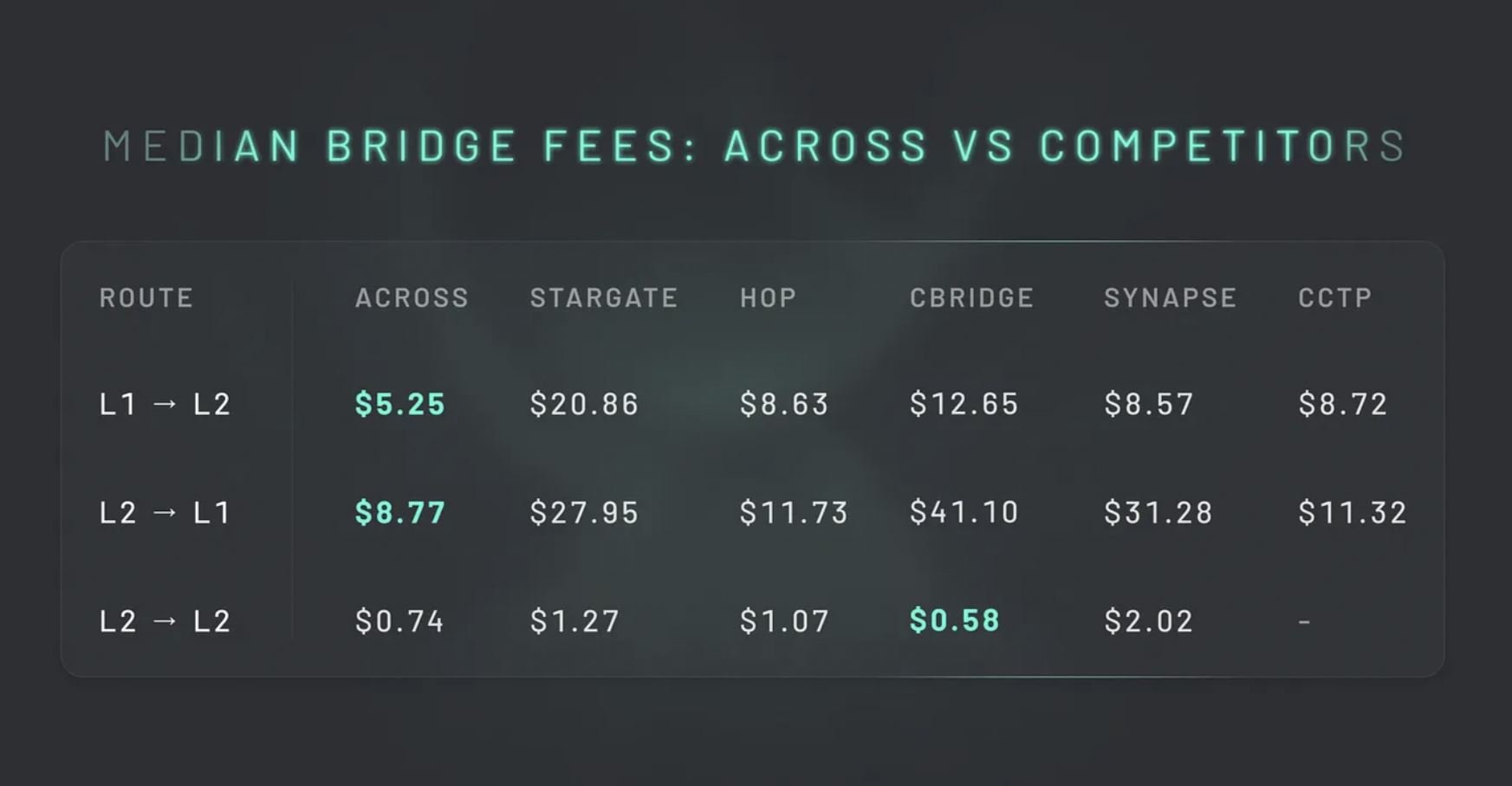

Due to this innovative design, Across pricing to customers is significantly better than the competition, with pricing up to 75% cheaper in some major routes. This is due to the capital efficiency of having a main hub pool from which all relayers are reimbursed, rather than multiple local pools on each chain that Across has to incentivize and pay liquidity providers for.

Source: Median bridge fees in Q2 2023, from Across Protocol Medium Article

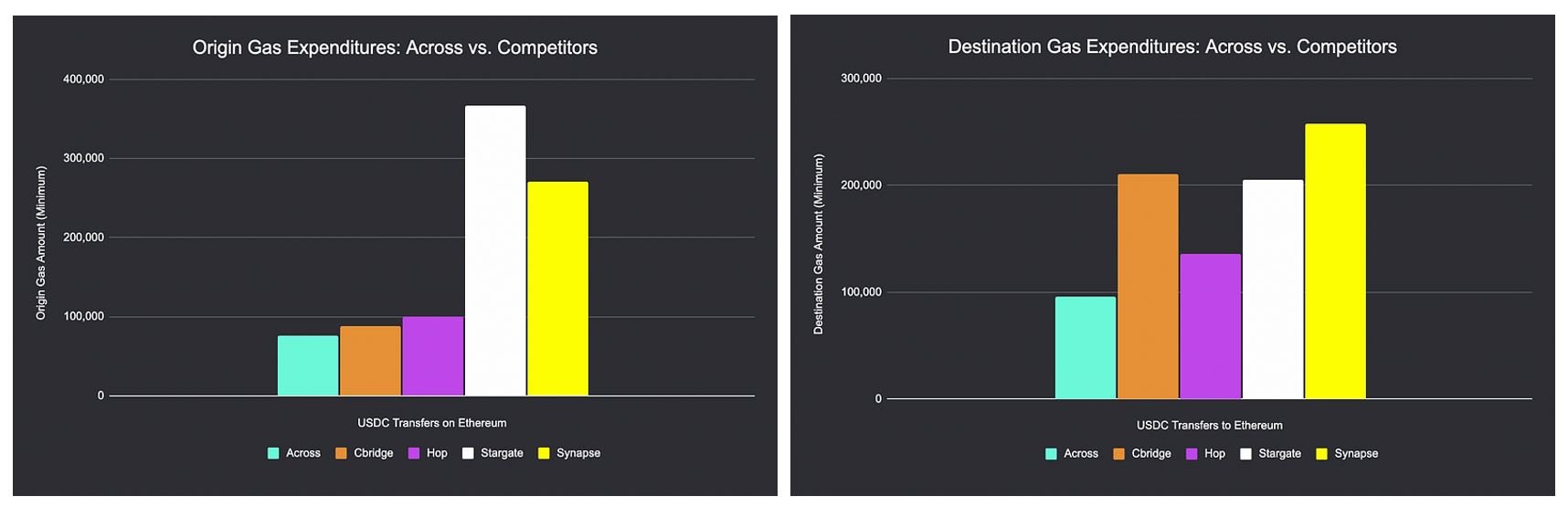

Across also has significantly lower origin and destination gas fees compared to competing bridges. This is due to its optimistic approach and doesn’t rely on gas intensive on-chain validations. In addition, Across is able to batch the gas fees it pays to reimburse relayers (by bridging funds in larger transactions through the canonical bridges). This leads to additional savings and more competitive rates for users vs other competing bridges.

Source: Origin and Destination Gas Fees in August 2023, from Across Protocol Medium Article

Source: Across Twitter. Minimal Theoretical Gas (MTG) score represents the amount bridges spend on transfers against the minimum expenditure for a transfer to get an idea of their gas efficiency.

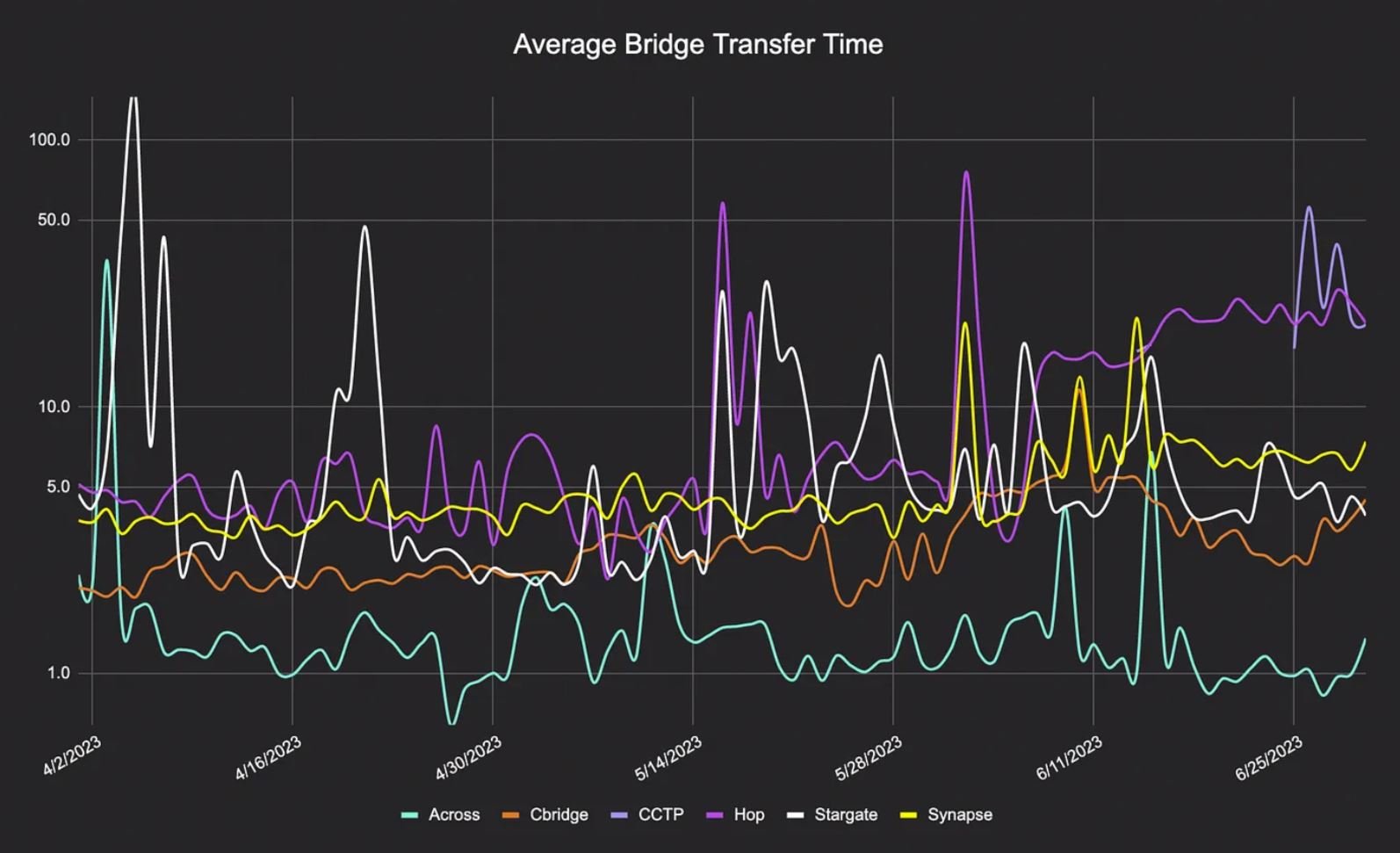

Notably, the lowest bridge and gas fees are achieved with the fastest bridging times, due to Across’ architecture that allows for relayers to front liquidity users on destination chains, and then get reimbursed from UMA’s optimistic oracle.

Over Q2 2023, Across had average bridge transfer times of approximately 2 minutes, compared to 5-7 minutes for the next most competitive bridges (Stargate, Synapse, cBridge).

Source: Average bridge transfer times for Q2 2023, from Across Protocol Medium Article

The result of a superior product experience for users (lowest bridge/gas fees + fastest bridging times) has been rapid growth through 2023. Across has grown from ~$30M/month of bridge volumes to $400M+ in November 2023.

Source: Token Terminal, Defi Llama [2]

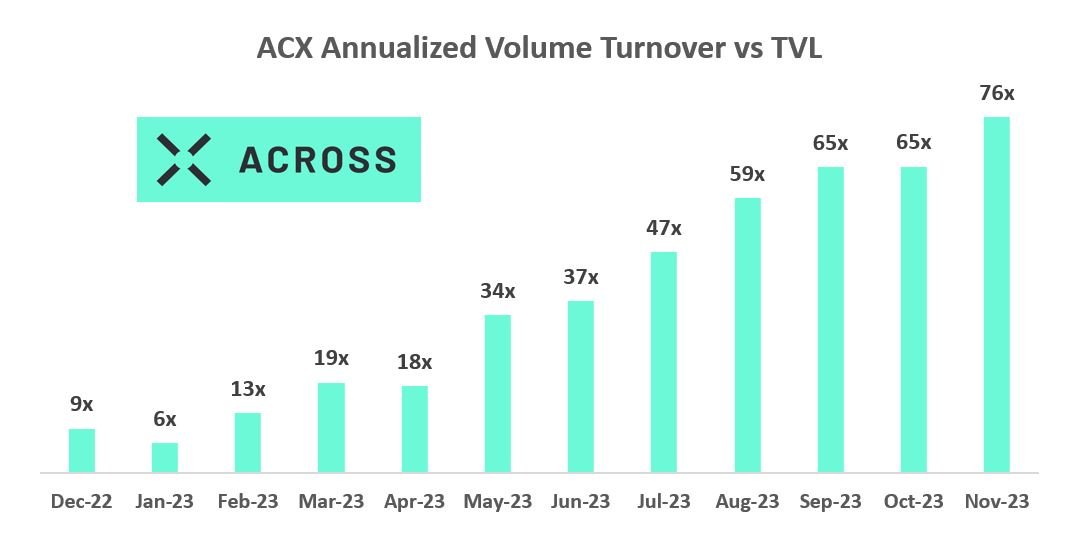

Importantly, the relay and intent design model of Across lends itself to very high capital efficiency.

Across monthly volumes have grown 12X+ since start of 2023, while TVL has only grown 50% (from $46M to $70M). As a result, annualized turnover for liquidity providers on TVL has grown 8X+ year to date, from 9x to 78x.

Source: Token Terminal, Defi Llama [2]

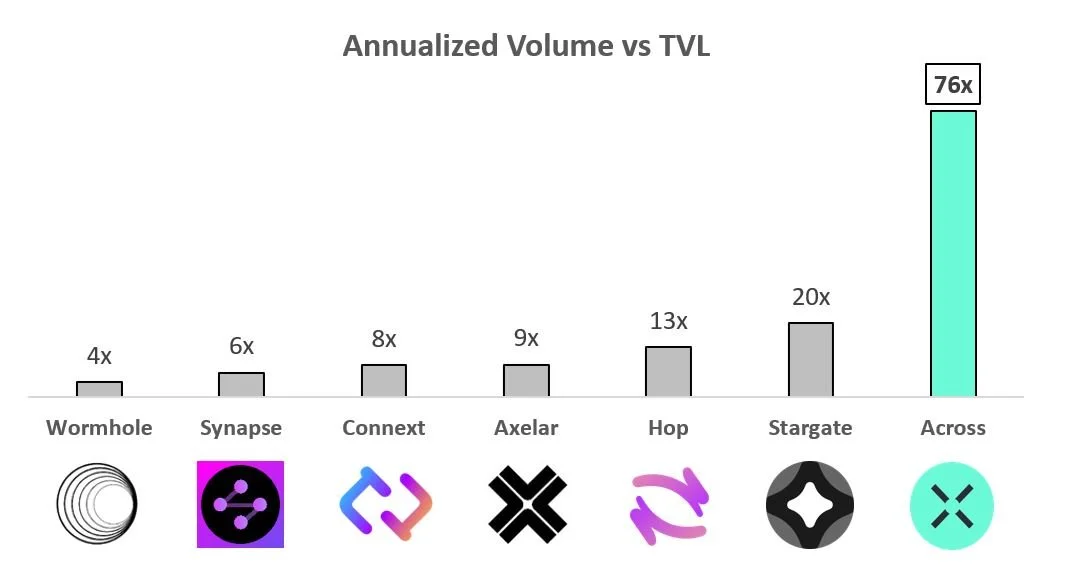

Across is by far the most capital efficient bridge, when measured by annualized volume vs TVL. Each dollar of TVL in Across is turned over 70-80x annually, compared to 20x for Stargate, and 4-13x for the rest of the bridge protocols. This is due to Across’ unique architecture, and we believe makes providing liquidity on Across economically sustainable and profitable in the long-run, in addition to reducing the attack surface (TVL) which has been targeted and drained in many bridge hacks.

Source: Token Terminal, Defi Llama, Synapse Explorer, Axelar Scan. Annualized volume is calculated based off November 2023 run-rate, and TVL using November 2023 average.

Liquidity providers earn attractive unincentivized APYs on Across vs other stable liquidity protocols [3]:

ETH and WETH Liquidity Providers on Across earn 4% base APY, compared to 2% base APY for the stETH/ETH pool on Curve

USDC and USDT Liquidity Providers on Across earn 2% base APY, compared to 0.5% base APY for the 3pool (DAI, USDC, USDT) on Curve

We believe there is room for Across LP APYs to continue growing with time, to be competitive with alternatives of ETH staking yields (3-4%) and USD treasury yields (5%), as Across continues to grow volumes in excess of TVL.

Bridge Market Analysis

The overall bridging market is roughly $60B volume annually. Approximately 2/3 of the market is through 1st party bridges (canonical or foundation run) and 1/3 of the market is through independent 3rd party bridges (which charge some fees, in return for much faster bridging times).

As more and more of the activity shifts to fragmented L2s and from L2 to L2 (vs. L1 to L2), we expect 3rd party bridges to grow usage and take share, due to the superior user experience relative to very small fees charged.

Notably, bridging L2<>L2 incurs significantly lower fees, often 90%+ cheaper than L1<>L2 bridging (due to the reduction in gas on Ethereum mainnet), making this a more viable, high frequency activity for users.

Source: Defi Llama

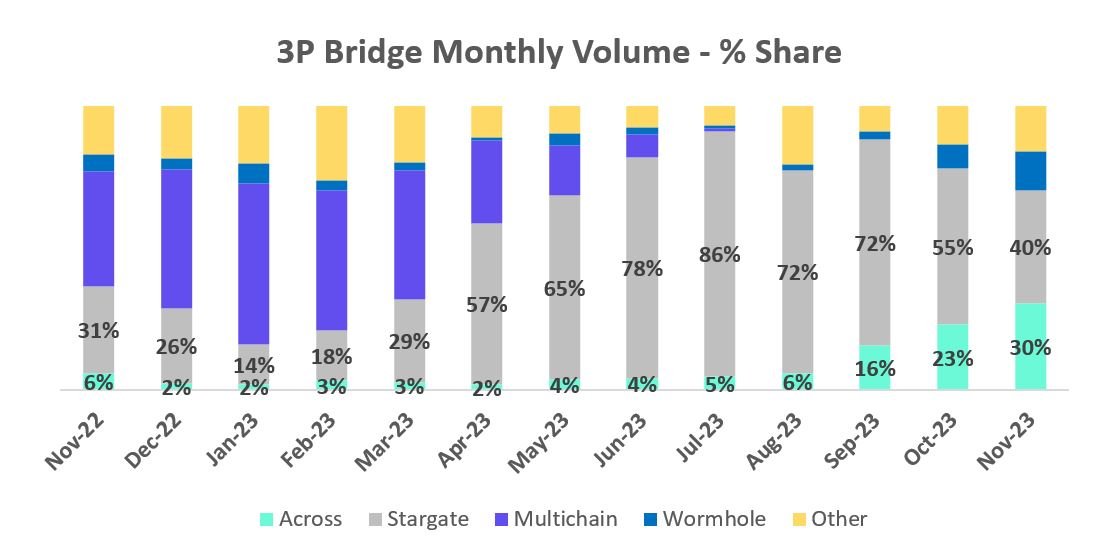

Within the bridging market, Stargate often screens as the #1 player (40% share as November 2023), having grown from 14% share in Jan 2023, to >80% share in peak months of July-Aug 2023.

Source: Token Terminal, Defi Llama, Synapse Explorer, Axelar Scan [4]

Stargate saw a noticeable surge in volumes after their $3B raise announcement in April 2023. During this period, many of the top trending dune dashboards have been related to qualifying for the LayerZero token airdrop.

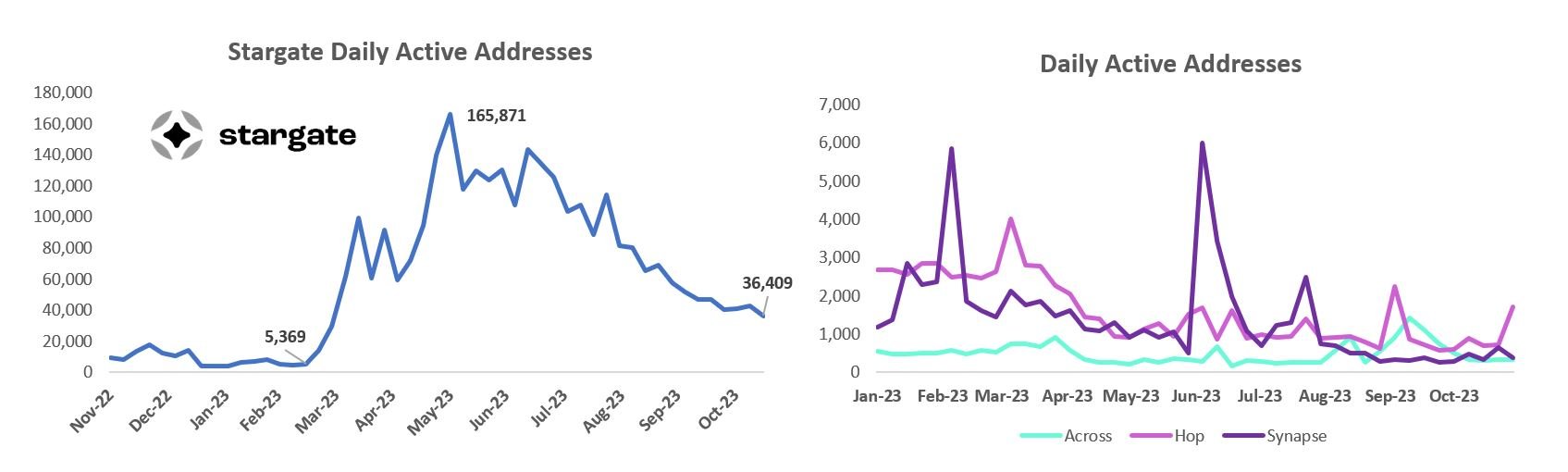

In addition, Stargate saw a notable increase in daily active addresses from ~5K (before the $3B fundraise announcement) to 165K+ at the peak (30x growth). This compares to daily active addresses from other bridge providers that range between 1-5K (Across, Hop, Synapse), which is more similar to Stargate dailies of 5K prior to the fundraise announcement.

Compared to the May to July 2023 period, daily actives addresses for Stargate have declined 75-80% from peak of 165K to 36K daily (still 7x vs pre-fundraise announcement levels).

Source: Artemis Analytics Chart Builder

Stargate volumes rapidly increased from $300M in February 2023, to $2-3B/month over the course of April to August 2023.

Since then volumes have normalized back to $500-600M monthly (November 2023). These are levels more in-line with Q1 2023 levels, before the fundraise announced.

Source: Token Terminal [2]

Excluding Stargate, 3rd party bridging volumes have been relatively stable when indexed against spot DEXs in the 1-2% range.

From all of the above analyses, it is possible the activity Stargate saw between months of April-August 2023, may have had impact from users intending to participate in the potential airdrop for the LayerZero token.

Across has gradually grown to capture 20-30% of the 3P bridging market. Over time we believe Across will capture closer to 50% market share.

When looking at market share excluding Stargate, Across has gained significant share, going from 20-30% share to 50% share today.

Source: Token Terminal, Defi Llama, Synapse Explorer, Axelar Scan [4]

Bridge aggregators have been playing an increasingly prominent role in the bridging space. A user selects the asset they want to bridge and the origin and destination chain. The bridge aggregator will show the cheapest and fastest bridging protocol. Given the ease of use and user experience, bridging aggregators (when excluding Stargate) has increased to low double digit percentage of the total market over the last few months. Aggregators like Socket have also been natively integrated into Coinbase Wallet.

With its lowest fees and fastest bridging times, Across has gained the most market share from bridge aggregators, representing 40-45% of total aggregator share.

In the case of aggregators like Socket (which operates Bungee Exchange), users interact with the smart contract “SocketGateway”, similar to have users of DEX aggregators interact with the 1inch or Paraswap smart contract rather than directly with Uniswap contracts. In order to be rewarded with airdrops, users would need to interact directly with Stargate’s smart contracts. We believe aggregator share shows a truer picture of long-term bridge market share.

Stargate holds 9% of Socket aggregator share for November 2023 month.

CCTP which is Circle’s native bridge for USDC has reached 25% of Socket aggregator share.

Source: Token Terminal, Defi Llama, Socket API Data

Monetization

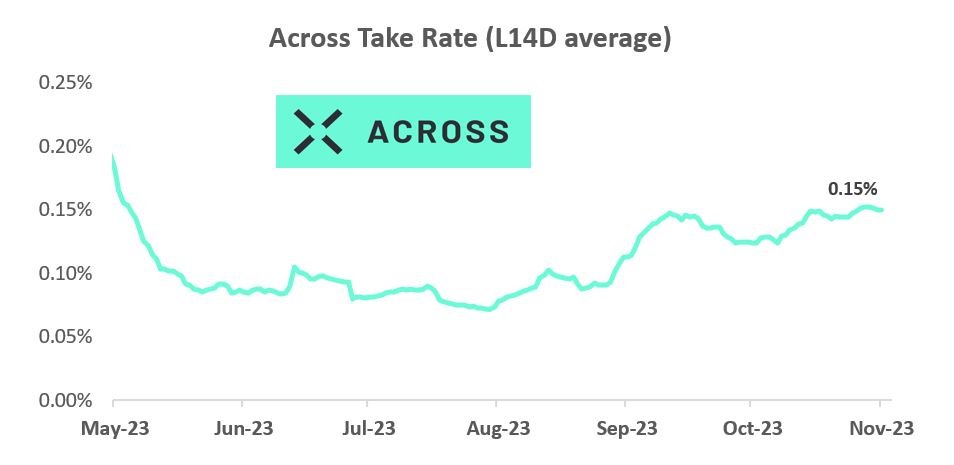

While Across does not monetize the protocol today, we believe Across could support 5bp take rate over time when looking at 1) pricing comparisons vs. other bridges; 2) defi protocol comparables.

Across currently monetizes at 10-15bp of total fees, which entirely goes to the liquidity providers and relayers.

Source: Token Terminal

Similar protocols that utilize liquidity providers capture 15-45% of the total gross fees generated. We believe Across could capture a similar portion (1/3 of the 15bp they charge), resulting in 5bp take rate to the Across DAO and thus $ACX token holders.

Uniswap does not charge fees today, but has proposed a 10% fee switch in the past (for Uniswap Protocol on select pools). In addition they also recently introduced a 0.15% additional fee for Uniswap front-ends (e.g. Uniswap.org website, Uniswap mobile app) which is on top of the fees paid to Uniswap liquidity providers, and a ~100% markup to the existing fees paid to liquidity providers.

Source: Token Terminal, Synapse Explorer

Valuation & Scenario Analysis

Below, we present a few scenarios flexing Across’ key drivers. In our base assumption:

We have assumed spot DEX volumes grows $700 billion to $1.5 trillion.

Spot DEX volumes peaked at $2.8 trillion and have hit $700B now (as well as post-FTX in December 2022). The drivers of spot DEX volumes are 1) crypto market cap (2-3x from $1T back to $3T); 2) CEX spot trading volume turnover vs. market cap (5x today vs. the 10-30x multiplier we’ve seen historically); 3) DEX penetration vs. CEX (DEX penetration has increased from LSD to teens today and should continue as activity moves on-chain)

Bridging volumes as a percentage of DEX volumes increase from 9% to 20%.

We believe this penetration will be driven by the proliferation and fragmentation of L2s. Given the amount of applications and users migrating to L2s, we believe this penetration will be sustainable

Third party bridging volumes hold at 50%.

Although we have not reflected this in our base case, we believe third party bridging volumes will gain share. Given the increasing fragmentation of L2, we believe most users will opt for third party bridges and aggregators. Furthermore, as more of the activity goes from L2 to L2, 1st party bridges will not be able to support these routes

Across share increases from 23% to 40% of 3rd party bridging volumes

Excluding Stargate, Across is already at 50% of bridging market share

Across is 40-45% of aggregator market share

Fee switch turns on net take rate to 5bps

Based on the pricing power Across has and what comparable defi protocols charge, we believe Across can take 5bps

Disclaimer: All forecasts, assumptions, and performance metrics are hypothetical

Risks & Mitigants

There are a few key risks we are actively monitoring for our investment in ACX:

CCTP – Circle, the native issuer of USDC, launched CCTP in April 2023 which allows users to natively mint and redeem USDC on different blockchains. Today, we have seen CCTP reach 25% of aggregator share in November 2023 month. However, USDC only represents about 40% of bridged assets and Circle is not running a competing front end and will integrate with existing bridges. Furthermore, CCTP is still significantly slower than Across (10-15 minutes to settle vs. 1-2 minutes for Across). Lastly, Across has been able to continue to grow volumes along with CCTP’s growth, demonstrating their co-existence in the market with different user segments.

Competition – Crypto markets are competitive, and there are many bridging options. Stargate has done a very good job with marketing and business development in anticipation of LayerZero airdrop. Hop/Synapse have done a good job being the first mover to new chains and capturing retail users. Axelar has seen a pickup in activity from recent activity in Cosmos chains (e.g. Celestia, dYdX, Sei). We are spending time closely monitoring both existing and new competitors in the space. We believe bridging architecture design and liquidity/capital efficiency remain defensible moats.

Hacks – Some of the largest hacks in crypto have been due to security issues around bridges. Given the technical complexity, bridges are a ripe attack vector. These include Multichain ($130M+), Wormhole ($300M+), Nomad ($190M), Poly Network ($610M). However, given Across utilizes the canonical bridges for these transfers, this massively reduces overall security risk. Furthermore, Across uses an optimistic design which is more secure than the MPC design, which has been at the root of recent hacks. Lastly, given its capital efficiency (75-80x annualized turnover), Across TVL is much less than its competitors per dollar of bridged volumes, which makes a >51% attack on UMA’s Optimistic Oracle less profitable for attackers.

Other L1 Coverage – One limitation to the Across approach to bridging is they have historically been limited to chains with canonical bridges to/from Ethereum. However, a recent partnership with Succinct (which uses light clients and zk proofs) will allow Across to expand to chains without canonical bridges and speed up new chain launches.

Atomic Composability – many L2s are currently working on shared sequencers to enable atomic composability of transaction execution across rollup chains. This is still a very early effort today (with Espresso Labs having struck partnerships with Optimism, Arbitrum and Polygon). With optimistic rollups, users are still subject to 7-day delay windows on bridging assets out, even if they are able to compose transaction execution across different rollup chains. With zk-rollup chains, it is possible atomic composability across chains with the shared proof layer, would reduce the need for asset bridges like Across in the end state, as all chains on the shared zk-proof layer have shared security assumptions once the proof is generated and can bridge trustlessly.

Token Supply - 10% of ACX supply was sold to investors, who are currently vesting tokens which mature on June 30, 2025, with an entry valuation of $200M FDV. Over 50% of the ACX token supply sits with the DAO Treasury, which need to be voted on to be allocated (done through Snapshot and oSnap). 15% of ACX supply is with the Foundation which are used for compensation with 4 year vesting schedules. The net effect is that the supply release for ACX tokens is quite gradual over the next few years.

Special thanks to Hart Lambur (Co-Founder, Across Protocol), Kevin Chan (Treasurer, Risk Labs), Chase Coleman (Data Science Lead, Risk Labs), Josh Solesbury (ParaFi), Mobius Research for their review and input.

[1] All forecasts and assumptions are hypothetical. See “Valuation & Scenario Analysis” section for details

[2] November 2023 volume is using monthly run-rate through November 18, 2023, given full month’s data is not yet available

[3] Approximate APYs taken from Curve and Across Protocol website on November 19, 2023

[4] Axelar typically processes $50-100M of monthly volumes. On August 21-22, 2023, Axelar processed $765M and $2.87B of daily volume respectively (= $3.6B total in 2 days), primarily related to bridging between BNB Chain to Sei Network for its launch and related token airdrop/claim. For context, the entire bridge space does $5-10B in monthly volumes. We exclude this $3.6B volume from our analysis to normalize for what we view as regular, ongoing bridge behavior and volumes

[**] Logos are protected trademarks of their respective owners and Modular Capital disclaims any association with them and any rights associated with such trademarks.

LEGAL DISCLAIMERS

THIS POST IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE RELIED UPON AS INVESTMENT ADVICE. This post has been prepared by Modular Capital Investments, LLC (“Modular Capital”) and is not intended to be (and may not be relied on in any manner as) legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to buy any securities of any investment product or any investment advisory service. The information contained in this post is superseded by, and is qualified in its entirety by, such offering materials.

THIS POST IS NOT A RECOMMENDATION FOR ANY SECURITY OR INVESTMENT. References to any portfolio investment are intended to illustrate the application of Modular Capital’s investment process only and should not be used as the basis for making any decision about purchasing, holding or selling any securities. Nothing herein should be interpreted or used in any manner as investment advice. The information provided about these portfolio investments is intended to be illustrative and it is not intended to be used as an indication of the current or future performance of Modular Capital’s portfolio investments.

AN INVESTMENT IN A FUND ENTAILS A HIGH DEGREE OF RISK, INCLUDING THE RIKS OF LOSS. There is no assurance that a Fund’s investment objective will be achieved or that investors will receive a return on their capital. Investors must read and understand all the risks described in a Fund’s final confidential private placement memorandum and/or the related subscription posts before making a commitment. The recipient also must consult its own legal, accounting and tax advisors as to the legal, business, tax and related matters concerning the information contained in this post to make an independent determination and consequences of a potential investment in a Fund, including US federal, state, local and non-US tax consequences.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS OR A GUARANTEE OF FUTURE RETURNS. The performance of any portfolio investments discussed in this post is not necessarily indicative of future performance, and you should not assume that investments in the future will be profitable or will equal the performance of past portfolio investments. Investors should consider the content of this post in conjunction with investment fund quarterly reports, financial statements and other disclosures regarding the valuations and performance of the specific investments discussed herein. Unless otherwise noted, performance is unaudited.

DO NOT RELY ON ANY OPINIONS, PREDICTIONS, PROJECTIONS OR FORWARD-LOOKING STATEMENTS CONTAINED HEREIN. Certain information contained in this post constitutes “forward-looking statements” that are inherently unreliable and actual events or results may differ materially from those reflected or contemplated herein. Modular Capital does not make any assurance as to the accuracy of those predictions or forward-looking statements. Modular Capital expressly disclaims any obligation or undertaking to update or revise any such forward-looking statements. The views and opinions expressed herein are those of Modular Capital as of the date hereof and are subject to change based on prevailing market and economic conditions and will not be updated or supplemented. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

EXTERNAL SOURCES. Certain information contained herein has been obtained from third-party sources. Although Modular Capital believes the information from such sources to be reliable, Modular Capital makes no representation as to its accuracy or completeness. This post may contain links to third-party websites (“External Sites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites. These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Sites.